Paul Nicklen: A Reverence for Nature

Standing in front of any of Canadian photographer Paul Nicklen’s large-scale images in the current exhibition at Hilton Contemporary, one cannot help but be totally…

Thought Leader: Paul Nicklen

This piece is by WWSG exclusive thought leader, Sara Fischer.

The Daily Wire is looking to possibly partner with a larger company or raise a significant round of capital next year to meet its growth ambitions, its co-CEO Jeremy Boreing told Axios.

Why it matters: The company’s commercial success has caught the attention of investors and potential buyers looking to gain a foothold in the younger conservative culture.

Between the lines: Asked about a deal with Fox, Boreing said the company isn’t actively looking for a buyer, but “we’re not closed off to an offer.”

By the numbers: The Nashville-based company, which is on track to surpass $200 million in revenue this year, would come with a hefty price tag.

Zoom in: In addition to subscriptions, the firm makes money from advertising and e-commerce.

The big picture: Like many modern media companies, The Daily Wire has started to pivot its focus away from social media and more toward its owned and operated channels.

The intrigue: Despite their political differences, Boreing says he’s taking cues from the New York Times.

What to watch: Most of Daily Wire’s content today is focused on news analysis and entertainment. But looking ahead, Boreing said the firm wants to invest more in original journalism.

Paul Nicklen: A Reverence for Nature

Standing in front of any of Canadian photographer Paul Nicklen’s large-scale images in the current exhibition at Hilton Contemporary, one cannot help but be totally…

Thought Leader: Paul Nicklen

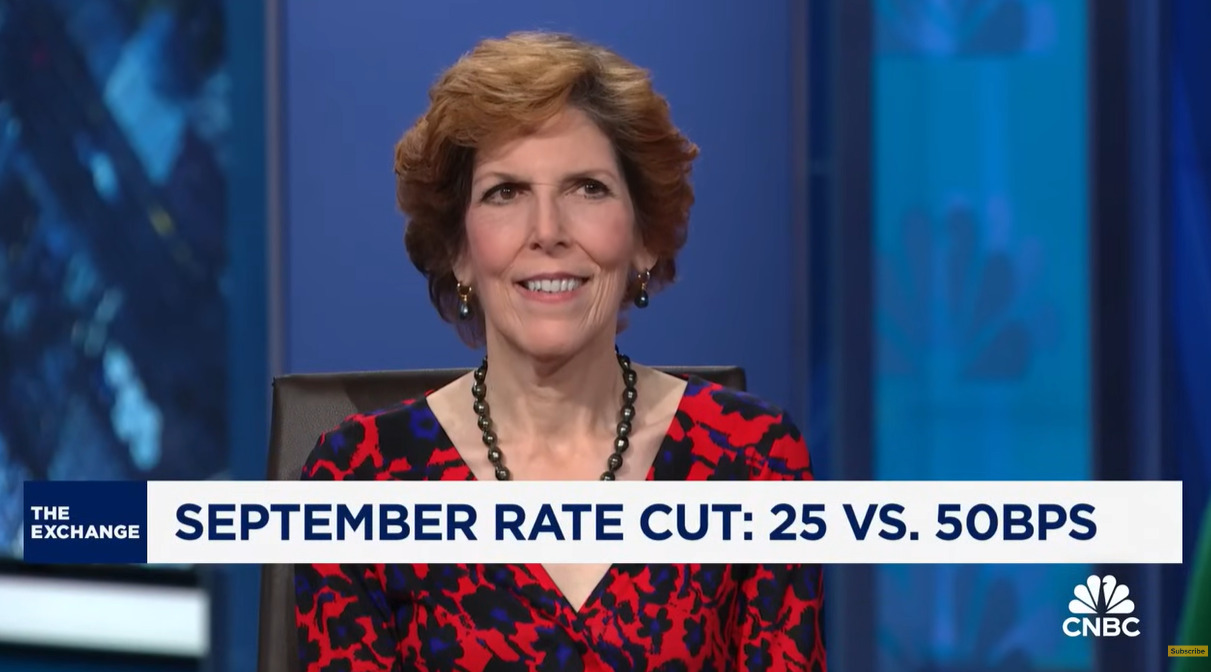

Loretta Mester: Fed most likely to cut rates by quarter point

Former Cleveland Fed president Loretta Mester joins CNBC’s ‘The Exchange’ to discuss her expectations for rate cuts, whether the Fed’s focus should be on rates…

Thought Leader: Loretta Mester

Kevin O’Leary: Kamala Harris’ ideas for US economy

Canadian businessman and investor Kevin O’Leary has slammed Kamala Harris’ “crazy” ideas for the US economy. Speaking with Fox News on Monday, the Shark Tank…

Thought Leader: Kevin O’Leary