Dr. Scott Gottlieb on Finding Cures for Rare Diseases

Former FDA Commissioner Dr. Scott Gottlieb joins ‘Squawk Box’ to discuss the ongoing research and efforts at the FDA to find cures for rare diseases.…

Thought Leader: Scott Gottlieb

Two years ago this month, former President Donald Trump announced that he was suspending federal student loan payments for 60 days as one of many economic relief programs launched in response to the COVID 19 pandemic. He later extended this “payment pause” until January 2021, which was extended again by President Biden to January 2022, and then again through May 1 of this year.

In announcing the extension to May 1, the president and his administration strongly communicated that payment obligations would resume and that borrowers needed to prepare. Then last Friday, the president’s chief of staff, Ron Klain, suggested the pause might again be extended, pending a decision on whether some portion of student debt should be cancelled altogether.

Klain is right that the president needs to decide about student debt cancellation before he decides on when to resume student loan repayments but wrong to keep this cloud of uncertainty over the heads of 40+ million student borrowers. They need to know whether and when their loan obligations will resume. With every delay, it becomes harder for them to prepare.

While the original case for the payment pause was compelling given the economic devastation caused by the pandemic, the situation is much different today.

Unemployment is low, jobs are plentiful, and the economy, if anything, is overheated from too much stimulus. There is no longer a need to boost consumer demand by providing extra cash to student borrowers. Moreover, as any private lender will tell you, the longer borrowers go without making their loan payments, the more difficulty they will have in resuming them. They become accustomed to managing their household budgets with the extra cash. Recommencing payments will require preparation time and planning. It will be no easy task.

Nor will it be easy for the federal government to convince some 40 million borrowers to start making payments again. The Department of Education’s new head of its Federal Student Aid office, Richard Cordray, has been busy preparing, launching a series of new educational and budget tools to help borrowers through the reinstatement process, and revamping student loan servicing, which has been plagued by inefficiency and dysfunction in the past. But his task will be virtually impossible if borrowers think cancellation of some or all student debt is in the offing.

Why resume loan payments when the government may eventually cancel your student loan?

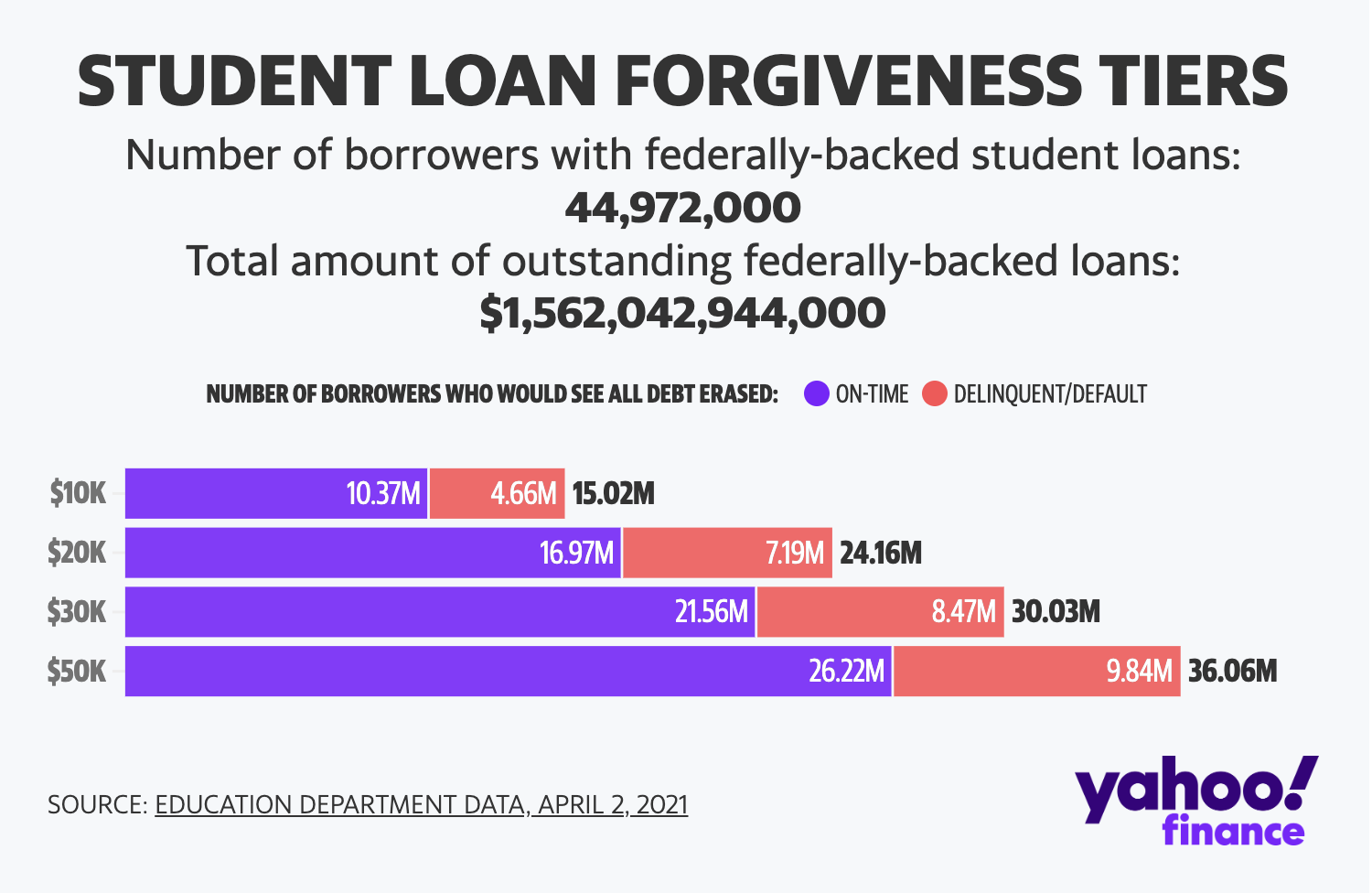

As a consequence, the administration’s first priority should be to decide what it wants to do on debt cancellation. But here, it has also been sending mixed messages. During the presidential campaign, the president supported $10,000 in debt forgiveness if authorized by Congress. Since then, he has indicated his administration is evaluating its executive authority to cancel some portion of student debt without Congressional approval and has not ruled out more aggressive proposals. Senator Elizabeth Warren, supported by Senate Majority Leader Chuck Schumer, has proposed cancelling up to $50,000 of debt, while Senator Bernie Sanders wants to wipe out virtually all of it.

Of the options to provide some level of loan forgiveness, the most compelling is the $10,000 amount. Indeed, debt forgiveness at that level would be life changing for almost half of all borrowers, wiping out all federal student debt for 12.8 million people and cutting it in half for an additional 7.7 million. Its primary beneficiaries are a sympathetic group. It would disproportionately benefit low-income borrowers and borrowers of color and would be of particular help to those who borrowed but never completed a degree. These borrowers have the burden of debt without the income-enhancing benefits of a college education. And it would help those borrowers already in financial distress. Half of all borrowers in default have loan balances less than $10,000.

That is not to say that borrowers owing more than $10,000 may not also need help, particularly given rising inflation. But the larger the amounts forgiven, the more expensive it becomes for taxpayers, while the benefits increasingly accrue to high-earning graduate and professional school students who have the bigger loan balances. Importantly, for any borrower who will have trouble resuming payments, there is the option to qualify for an income-driven repayment (IDR) plan, where payments are kept to an affordable percentage of what they earn. Unfortunately, the federal government offers a confusing array of IDR plans and the application process can be daunting. The Department of Education is working to consolidate those multiple plans into a single, simplified option with virtually automatic enrollment for those needing relief from standard repayment plans. This effort should be applauded.

I am a longstanding critic of the current student loan program because of its fundamental misalignment of incentives, putting all the risks on students and taxpayers, with little accountability for colleges to make sure loans are affordable and students actually receive a meaningful education that will help them secure good incomes and jobs. Too many students have been ripped off by poor quality schools. Too many have been convinced to take on mega sized loans to pursue graduate degrees of questionable worth (including by a number of Ivy League schools). But the fact remains, even with these problems, most student borrowers have received worthwhile degrees. And given the availability of IDRs in addition to the standard 10-year repayment plans, the majority can afford to start repaying taxpayers.

Student loans are typically a young person’s first experience with debt. The lesson they should be learning is that debt is a serious thing, a claim on their financial futures. They should carefully research and understand how much debt they can comfortably incur given their desired field and career path. Instead, student loans are euphemistically called “financial aid” and students are encouraged to maximize federal borrowing, instead of thoughtfully limiting it to sustainable levels. Endless equivocating by the government about whether borrowers will ever need to repay their loans undermines personal accountability and creates confusion about the need to live up to one’s legal obligations. Wholesale forgiveness may well encourage even more over-borrowing by creating an expectation that there will be additional forgiveness down the road.

Of course, surveys show overwhelming support among student borrowers for loan forgiveness. Cancel my debt? Sure, that sounds good. But I believe most are prepared to pay and willing to pay if given firm direction from the government. It sounds as if the administration will grant one more extension.

Dr. Scott Gottlieb on Finding Cures for Rare Diseases

Former FDA Commissioner Dr. Scott Gottlieb joins ‘Squawk Box’ to discuss the ongoing research and efforts at the FDA to find cures for rare diseases.…

Thought Leader: Scott Gottlieb

Peter Zeihan: U.S. Navy Seizes Russian Tanker

The US Navy just seized a shadow fleet tanker that managed to slip past the naval quarantine around Venezuela. The tanker reflagged as Russian while…

Thought Leader: Peter Zeihan

Erika Ayers Badan: Surviving Company Failure

In this episode of WORK: Unsolicited Advice, Erika talks through what it really looks like to come out of the worst month of your career…

Thought Leader: Erika Ayers Badan