Erika Ayers Badan: You Are The Problem (And The Solution)

This is an episode for people grappling with how to manage and how to embrace AI. Good managers in the future will seamlessly balance being…

Thought Leader: Erika Ayers Badan

By Mary Anastasia O’Grady (original source The Wall Street Journal)

‘I really don’t think we should be guaranteeing Wall Street a margin by guaranteeing them a zero or a near zero interest rate.’

In the aftermath of the 2008 financial panic centered on Wall Street, it’s easy to forget that this part of America has its own bitter history of wild speculation that ended in disaster. But Kansas City Federal Reserve Bank President Thomas Hoenig remembers the 1970s all too well. It was a lesson that still shapes his thinking about the role of the Fed’s monetary policy in creating asset bubbles. Mr. Hoenig is more than just one of the 12 regional bank presidents of the Federal Reserve. Right now he’s also a voting member of the Fed’s Open Market Committee, which sets U.S. monetary policy. In recent months he’s been the committee’s sole dissident on the Fed’s promise to keep interest rates “at exceptionally low levels” for “an extended period of time.” At April’s FOMC meeting, Mr. Hoenig objected to that language for the third meeting in a row, warning that those words are inviting a kind of trouble we’ve seen before. “I’ve been in the Federal Reserve for many years, since 1973, and I started out in bank supervision here at the Federal Reserve Bank of Kansas City,” Mr. Hoenig tells me in an interview in his office. “During the ’70s, we went through a time where interest rates were low” and “through that period I saw banks and others invest [based on inflated] asset values—including farm land, including commercial real estate, including the movement in energy prices and on projections that in 1980 oil would go to $100 a barrel.” That oil and real-estate boom ended badly, with a rash of bank failures and financial ruin that set this region back considerably. Though Mr. Hoenig acknowledges that he can’t predict bubbles, “when you have an extended period of time with very low interest rates . . . those are some of the necessary conditions that will enable very rapid credit expansion leading to bubbles, perhaps. At least the likelihood of bubbles is greater under those circumstances.”

Click here to read more

Erika Ayers Badan: You Are The Problem (And The Solution)

This is an episode for people grappling with how to manage and how to embrace AI. Good managers in the future will seamlessly balance being…

Thought Leader: Erika Ayers Badan

Patrick McGee: Tesla’s Robotaxi Bait and Switch

Elon Musk called self-driving cars a ‘solved problem’ 10 years ago. So how come he’s still working on it? In a new column, Patrick McGee…

Thought Leader: Patrick McGee

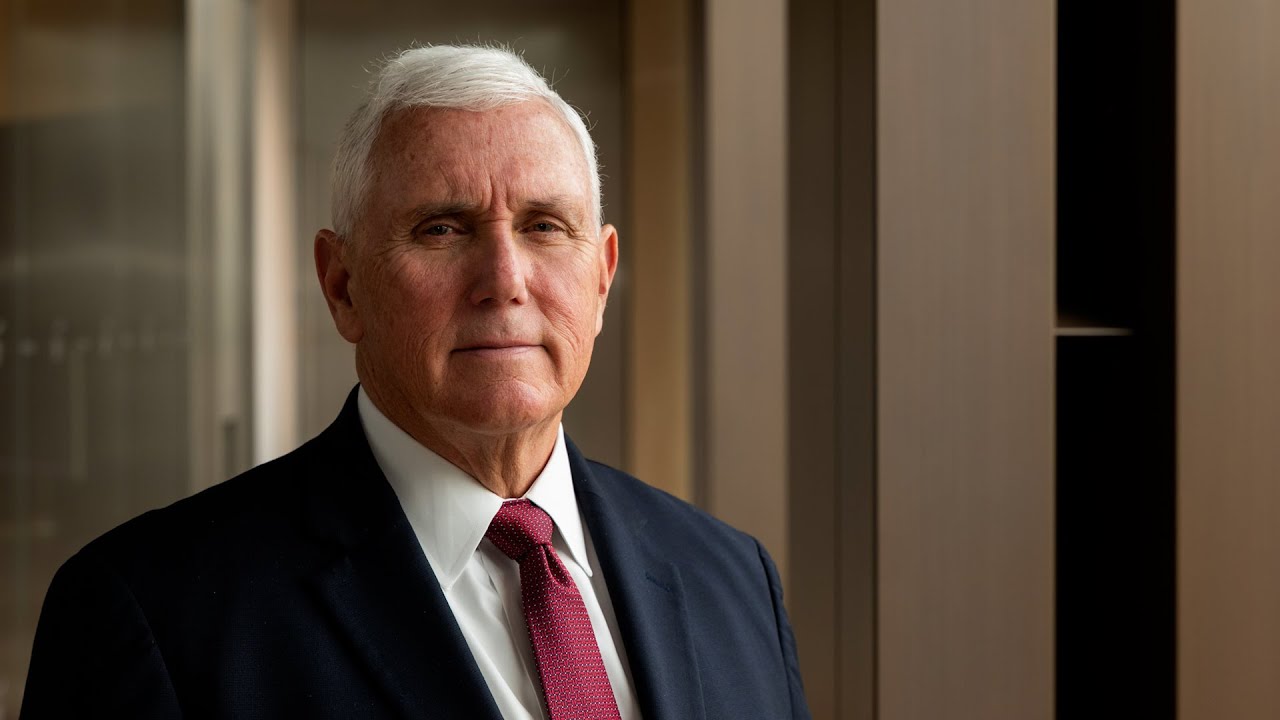

Mike Pence on U.S. Leadership and Global Strategy

Former Vice President of the United States, Mike Pence, shares his thoughts about President Trump’s framework on trying to acquire Greenland, and discusses what he…

Thought Leader: Mike Pence