Erika Ayers Badan: You Are The Problem (And The Solution)

This is an episode for people grappling with how to manage and how to embrace AI. Good managers in the future will seamlessly balance being…

Thought Leader: Erika Ayers Badan

What is the money of the future? My nine-year-old son thinks it will be Robux. For those of you trapped in the human museum known as adulthood, Robux is the currency used by players of Roblox computer games. If I offer Thomas grimy dollar bills for household chores, he shows an almost complete lack of interest and motivation. But if I offer him Robux, it’s a different story.

The current exchange rate is around 80 to the dollar. So, in order to incentivize my son to do the dishes, I need to go online and buy 2,000 Robux for $24.99. This I do by entering my credit card details on a website, an act of self-exposure that never fails to make me feel sick. However, the dishes get cleaned and, later, my son blows some of his Robux on a cool new outfit and a pair of wings for his avatar, earning the admiration of his friends.

Robux is just one of the new forms of money that exist in the parallel world of online gaming. If your kids play Fortnite, then you’ve probably had to buy them V-Bucks (short for VinderBucks). And gamer money is, in turn, just a subset of the myriad means of payment that now exist on the internet.

Writers of science fiction got many things right about the future, from pandemics to flying cars to artificial intelligence. None, so far as I know, got the future of money exactly right. In William Gibson’s seminal Neuromancer (1984), paper money (the “new yen” or N¥) has survived but is used only for illicit transactions. In Neal Stephenson’s Snow Crash (1992), hyperinflation has ravaged the value of the dollar so much that, in Compton, California, “Street people push … wheelbarrows piled high with dripping clots of million- and billion-dollar bills that they have raked up out of storm sewers.” A trillion-dollar bill is known colloquially as an “Ed Meese.” A quadrillion is a “Gipper.” (Only we Boomers now get the allusions to the former attorney general and the president he served in the 1980s.) In other dystopian futures, readily available commodities such as bullets or bottle caps serve as makeshift money, rather like cigarettes in occupied Germany in the immediate aftermath of World War II. My favorite imagined currency are the “merits” in the British TV show Black Mirror, which have to be earned by pedaling on exercise bikes.

If some other author predicted the future of money accurately, I missed it. Unfortunately, this lack of foresight now seems also to afflict U.S. policymakers, leaving the world’s financial hegemon vulnerable to a potentially fatal challenge. Not only are the American monetary authorities underestimating the threat posed to dollar dominance by China’s pioneering combination of digital currency and electronic payments. They are also treating the blockchain-based financial innovations that offer the best alternative to China’s e-yuan like gatecrashers at their own exclusive party.

Let’s begin with the future of money that no one foresaw.

In 2008, in a wonkish paper that bore no relation to any sci-fi, the enigmatic Satoshi Nakamoto launched Bitcoin, “a purely peer-to-peer version of electronic cash” that allows “online payments to be sent directly from one party to another without going through a financial institution.” In essence, Bitcoin is a public ledger shared by an acephalous (leaderless) network of computers. To pay with bitcoins, you send a signed message transferring ownership to a receiver’s public key. Transactions are grouped together and added to the ledger in blocks, and every node in the network has an entire copy of this blockchain at all times. A node can add a block to the chain (and receive a bitcoin reward) only by solving a cryptographic puzzle chosen by the Bitcoin protocol, which consumes processing power.

Nodes that have solved the cryptographic puzzle — “miners” — are rewarded not only with transaction fees, but also with more bitcoins. This reward will get cut in half every four years until the total number of bitcoins reaches 21 million, after which no new Bitcoins will be created. As I argued here last November, there were good reasons why Bitcoin left gold for dead as the pandemic was wreaking havoc last year. Scarcely over a year ago, when just about every financial asset sold off as the full magnitude of the pandemic sank in, the dollar price of a Bitcoin fell to $3,858. As I write, the price is $58,746.

The reasons for Bitcoin’s success are that it is sovereign (no one controls it, not the “whales” who own a lot, and not the miners who mine a lot), scarce (that 21 million number is final), and — above all — smart. With every day that the system works — not being hacked, not crashing — the predictions that it would prove to be a “shitcoin” look dumber, and the pressure on people to affirm their smartness by owning bitcoins grows stronger. Last year, a bunch of tech companies, including Square, PayPal and Tesla, bought a pile. Several legendary investors — Paul Tudor Jones, Stan Druckenmiller, Bill Miller — came out as long Bitcoin. Perhaps most importantly, Bitcoin began to be treated like a legitimate part of the financial system. BNY Mellon now handles Bitcoin. So does Mastercard. There are now well functioning Bitcoin futures and options markets. This kind of adoption and integration is what has driven the price upward — a process that has much further to run. My $75,000 target price back in 2018 (assuming that every millionaire would one day want 1% of his or her portfolio in XBT) now looks a bit conservative.

Meanwhile, as Bitcoin has grown more respectable, the cool kids have moved on to decentralized finance (“DeFi”), “an open, permissionless, and highly interoperable protocol stack built on public smart contract platforms” such as the Ethereum blockchain, to quote a recent and excellent St. Louis Fed paper by Fabian Schaer. Like Bitcoin, DeFi has no centralized third-party system of verification and regulation. But it is a much looser, more variegated system, with multiple coins, tokens, exchanges, debt markets, derivatives and asset management protocols. As Schaer puts it:

This architecture can create an immutable and highly interoperable financial system with unprecedented transparency, equal access rights, and little need for custodians, central clearing houses, or escrow services, as most of these roles can be assumed by ‘smart contracts.’ … Atomic swaps, autonomous liquidity pools, decentralized stablecoins, and flash loans are just a few of many examples that show the great potential of this ecosystem. … DeFi may lead to a paradigm shift in the financial industry and potentially contribute toward a more robust, open, and transparent financial infrastructure.

(I told you it was cool.)

For the true believers, Bitcoin and DeFi are the first steps toward a libertarian Nirvana. In a widely quoted tweet, crypto guru Naval Ravikant added steps three to seven:

Bitcoin is an exit from the Fed.

DeFi is an exit from Wall Street.

Social media is an exit from mass media.

Homeschooling is an exit from industrial education.

Remote work is an exit from 9-5.

Creator economy is an exit from employment.

Individuals are leaving institutions.

We are on our way, according to Piers Kicks, to the “Metaverse” — a “self-sovereign financial system, an open creator economy, and a universal digital representation and ownership layer via NFTs (non-fungible tokens).” Yes, even art is now on the blockchain: Witness the sale by Christie’s last month of “Everydays: the First 5000 Days,” by Mike Winkelmann, aka Beeple, for $69.3 million.

What is the right historical analogy for all this? Allen Farrington argues that Bitcoin is to the system of fiat currencies centered around the dollar what medieval Venice once was to the remnants of the western Roman Empire, as superior an economic operating system as commercial capitalism was to feudalism. Another possibility is that the advent of blockchain-based finance is as revolutionary as that of fractional reserve banking, bond and stock markets in the great Anglo-Dutch financial revolution of the 18th century.

Like all such revolutions, however, this one, too, has produced its haters. Well-known economists such as Nouriel Roubini continue to predict Bitcoin’s demise. Bridgewater founder Ray Dalio has warned that, just as the U.S. government prohibited the private ownership of gold by executive order in April 1933, so the same fate could befall Bitcoin. Perhaps most ominously, the central bankers of the western world remain sniffy. A new line of attack (highly appealing to monetary officials eager to affirm their greenness) is that the electricity consumed by Bitcoin miners makes crypto dirty money.

Are we therefore heading for a collision between the old money and the new? Perhaps. As we approach the end of the first 100 days of Joe Biden’s presidency, I am tempted to paraphrase his former boss’s jab at Mitt Romney back in 2012: “The twentieth century is calling to ask for its economic policy back.” There is something very old-school about the Biden administration.

It believes in Keynesian demand management and stimulus. It is proposing a massive infrastructure investment plan. The result is that fiscal and monetary expansion triggered by a public health emergency seems set to continue beyond the duration of the emergency. The administration’s economists tell us there is nothing to fear from inflation. Meanwhile, in foreign policy, Team Biden seems committed to Cold War II against China. All of this hinges on the enduring credibility of the U.S. dollar as the preeminent international reserve currency and U.S. Treasury bonds as the safest of all financial assets — not to mention the enduring effectiveness of financial sanctions as the ultimate economic weapon. Yet precisely these things are threatened by the rise of an alternative financial system that essentially bypasses the Federal Reserve and potentially also the U.S. Treasury.

So you can see why Ray Dalio might expect the U.S. government at some point to outlaw Bitcoin and other cryptocurrency. The last administration occasionally muttered threats. “Cryptocurrency … provides bad actors and rogue nation states with the means to earn profits,” stated the report of Attorney General William Barr’s Cyber-Digital Task Force last year. Treasury Secretary Steven Mnuchin considered forcing U.S. exchanges to gather more information about individuals withdrawing their Bitcoin. Pro-Bitcoin politicians, such as Miami mayor Francis Suarez, are still in a minority.

Abroad, too, there are plenty of examples of governments moving to limit cryptocurrencies or ban them altogether. “We must do everything possible to make sure the currency monopoly remains in the hands of states,” declared German Finance Minister Olaf Scholz at a G-7 finance ministers meeting in December. The European Commission shows every sign of regulating the fledgling sector with its customary zeal. In particular, the European Central Bank has stablecoins (crypto tokens pegged to fiat currencies) in its sights. China is even more stringent. In 2017, the Chinese Communist Party restricted the ability of its citizens to buy Bitcoin, though Bitcoin mining continues to thrive close to sources of cheap hydroelectricity like the Three Gorges Dam.

But is it actually true that the state should have a monopoly on money? That is a distinctly German notion, stated most explicitly in Georg Friedrich Knapp’s State Theory of Money (1905). History begs to differ. Although states have sometimes sought to monopolize money creation, and although a state monopoly on the enforcement of debt contracts is preferable, a monopoly on money is far from natural or even necessary. For most of history, states have been satisfied with determining what is legal tender — that is, what can be used to discharge contractual obligations, including tax payments. This power to specify legal tender drove the great monetization of economy and society in Ming China and in Europe after the Black Death.

Money, it is conventional to argue, is a medium of exchange, which has the advantage of eliminating inefficiencies of barter; a unit of account, which facilitates valuation and calculation; and a store of value, which allows economic transactions to be conducted over long time periods as well as geographical distances. To perform all these functions optimally, the ideal form of money has to be available, affordable, durable, fungible, portable and reliable. Because they fulfill most of these criteria, metals such as gold, silver and bronze were for millennia regarded as the ideal monetary raw material. Rulers liked to stamp coins with images (often crowned heads) that advertised their authority. But in ancient Mesopotamia, beginning around five thousand years ago, people used clay tokens to record transactions involving agricultural produce like barley or wool, or metals such as silver. Such tablets performed much the same function as a banknote. Often, through the centuries, traders have devised such tokens or bills without government involvement, especially at times when coins have been in short supply or debased and devalued.

In the modern fiat monetary system, the central bank, itself supposedly independent of the state, can influence the money supply, but it does not monopolize money creation. In addition to state-created cash — the so-called high-powered money or monetary base — most money is digital credits from commercial banks to individuals and firms. As I argued in The Ascent of Money (2008), money is trust inscribed, and it does not seem to matter much whether it is inscribed on silver, on clay, on paper — or on a liquid crystal display. All kinds of things have served as money, from the cowrie shells of the Maldives to the stone discs used on the Pacific island of Yap.

Although Bitcoin currently looks to outsiders like a speculative asset, in practice it performs at least two of the three classic functions of money quite well, or soon will, as adoption continues. It can be (like gold) both a store of value and a unit of account. And, as my Hoover Institution colleague Manny Rincon-Cruz has suggested, it may be that the three classic functions of money are in fact something of a trilemma. Most forms of money can perform at least two of the three; it’s impossible or very hard to do all three. Bitcoin is not an ideal medium of exchange precisely because its ultimate supply is fixed and not adaptive, but that’s not a fatal limitation. In many ways, it is Bitcoin’s unique advantage.

In other words, Bitcoin and Ethereum, as well as a great many other digital coins and tokens, are stateless money. And the more they can perform at least two out of three monetary functions tolerably well, the less that banning them is going to work — unless every government agrees to do so simultaneously, which seems like a stretch. The U.S. isn’t going to ban Bitcoin, just tax it whenever you convert bitcoins into dollars.

The right question to ask is therefore whether or not the state can offer comparably appealing forms of digital money. And this is where the Chinese government has been thinking a lot more creatively than its American or European counterparts. As is well known, China has led the world in electronic payments, thanks to the vision of Alibaba and Tencent in building their Alipay and WeChat Pay platforms. In 2020, some 58% of Chinese used mobile payments, up from 33% in 2016, and mobile payments accounted for nearly two-thirds of all personal consumption PBOC payments. Banknotes and credit cards have largely yielded to QR codes on smartphones. The financial subsidiary of Alibaba, Ant Group, was poised last year to become one of the world’s biggest financial companies.

Yet the Communist Party became nervous about the scale of electronic payment platforms and sought to clip their wings by cancelling Ant’s planned IPO in November and tightening regulation. At the same time, the People’s Bank of China has accelerated the implementation of its plan for a central bank digital currency (CBDC). In a fascinating article in February, former PBOC governor Zhou Xiaochuan explained the fundamentally defensive character of this initiative. “Blockchain technology features decentralization, but decentralization is not a necessity for modernizing the payments system. It even has some drawbacks,” he wrote. “The possible application of blockchain … is still being researched, but is not ready at this time.”

Last year, the PBOC seized the opportunity presented by the pandemic to rush its CBDC into the hands of Chinese consumers, conducting trials in three cities — Shenzhen, Suzhou and Chengdu — as well as the Xiong’an New Area near Beijing. Crucially, its design is two-tier, with the PBOC dealing with the existing state-owned commercial banks and other entities (including telecom and tech companies), not directly with households and firms. The abbreviation “DC/EP” (with the slash) captures this dual structure. The central bank controls the digital currency, but the electronic payment platforms can participate in the system, alongside the banks, as intermediaries to consumers and businesses. However, the easiest option for consumers will clearly be to withdraw “e-CNY” from bank ATM machines onto their smartphones’ e-wallets. The system even allows transactions to happen in the absence of an internet connection via “dual offline technology.” In 2018 I predicted there would soon be “bityuan.” I only got the name wrong.

This new Chinese system not only defends the CCP against the twin threats of crypto and big tech, while ensuring that all Chinese citizens’ transactions are under surveillance; it also includes an offensive capability to challenge the U.S. dollar’s dominance in cross-border payments. And this is where the story gets seriously interesting. Today, as is well known, the dollar dominates the renminbi in foreign exchange markets, central bank reserves, trade finance and bank-to-bank payments through the Belgium-based Society for Worldwide Interbank Financial Telecommunication (SWIFT). This financial superpower, fully appreciated and utilized only after 9/11, is what makes U.S. financial sanctions so effective and far-reaching.

The Chinese are creatively exploring ways to change that. Exhibit A is the Finance Gateway Information Service, a joint venture between SWIFT and the China National Clearing Center within the PBOC, which aims to direct all cross-border yuan payments through China’s own settlement system, Cross-Border Interbank Payment and Clearing. Exhibit B is the Multiple CBDC (mCBDC) Bridge project by the Hong Kong Monetary Authority and the Bank of Thailand to implement a cross-border payments system based on distributed ledgers, again using a two-tier system. Exhibit C are the cross-border transfers between Hong Kong and Shenzhen currently being piloted. According to Sahil Mahtani of the South African investment manager Ninety One, the ultimate goal of Chinese policy is “to create a parallel payments network — one beyond American oversight — thereby crippling U.S. sanctions policy.” In Mahtani’s words:

The expansion of a Chinese digital currency will ultimately pry open the U.S. grip over global payments, and therefore compromise U.S. sanctions policy and a significant measure of U.S. power in the world. … It is not that China’s digital currency is going to become the dominant standard of payments … But it could become one standard, creating a parallel system with which to avoid the long arm of U.S. regulation.

What does the United States have to offer in response? When Mark Carney, the former Governor of the Bank of England, argued for a “synthetic hegemonic currency” at Jackson Hole in 2019, he was politely ignored. When Mark Zuckerberg proposed a Facebook stablecoin, Libra, he was impolitely rebuffed. (Libra has been renamed “Diem,” but getting regulatory approval still looks like an uphill struggle. According to Tyler Goodspeed, who recently left the Council of Economic Advisers to join us at Hoover, “If you’re issuing very short-term liquid liabilities that are redeemable on demand for, say, dollars or euros, and you’re backing that commitment by holding highly liquid dollar- or euro-denominated bills, then I’m sorry to say it but you are a bank.”

Other countries are exploring creating their own CBDCs — 60% of more than 60 central banks surveyed by the Bank for International Settlements last year. Cambodia and the Bahamas are already there. Even the European Central Bank has not said “non” or “nein,” though Bundesbank head Jens Weidmann is not alone in worrying that an e-euro might disintermediate Europe’s already ailing banks unless the Chinese two-tier model is adopted.

And the Fed? According to Chair Jay Powell, some of his officials are working with economists at the Massachusetts Institute of Technology to explore the feasibility of a U.S. CBDC. But, says Powell, “there is no need to rush.” Like his “What me, worry?” approach to inflation, this smacks of insouciance. China is seeking in plain sight to build an alternative international payments system to that of the U.S. dollar, and there’s no need to rush to meet this challenge? Nor any thought of actively integrating Bitcoin — a tried and tested decentralized form of “digital gold” — into the U.S. financial system, rather than treating it as a rather suspect parvenu?

If the future of money arrives as rapidly as I think it will, in the form of a widely adopted e-CNY, do not be surprised if all we can offer our kids are Robux.

Erika Ayers Badan: You Are The Problem (And The Solution)

This is an episode for people grappling with how to manage and how to embrace AI. Good managers in the future will seamlessly balance being…

Thought Leader: Erika Ayers Badan

Patrick McGee: Tesla’s Robotaxi Bait and Switch

Elon Musk called self-driving cars a ‘solved problem’ 10 years ago. So how come he’s still working on it? In a new column, Patrick McGee…

Thought Leader: Patrick McGee

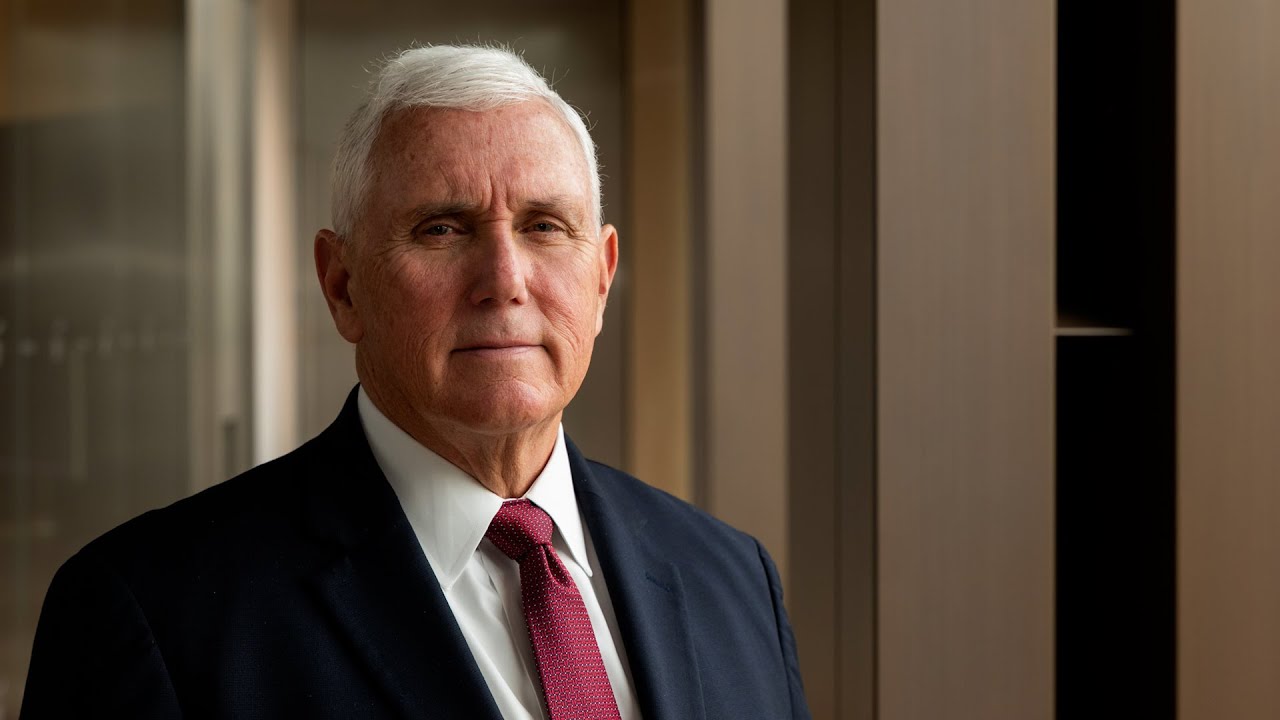

Mike Pence on U.S. Leadership and Global Strategy

Former Vice President of the United States, Mike Pence, shares his thoughts about President Trump’s framework on trying to acquire Greenland, and discusses what he…

Thought Leader: Mike Pence