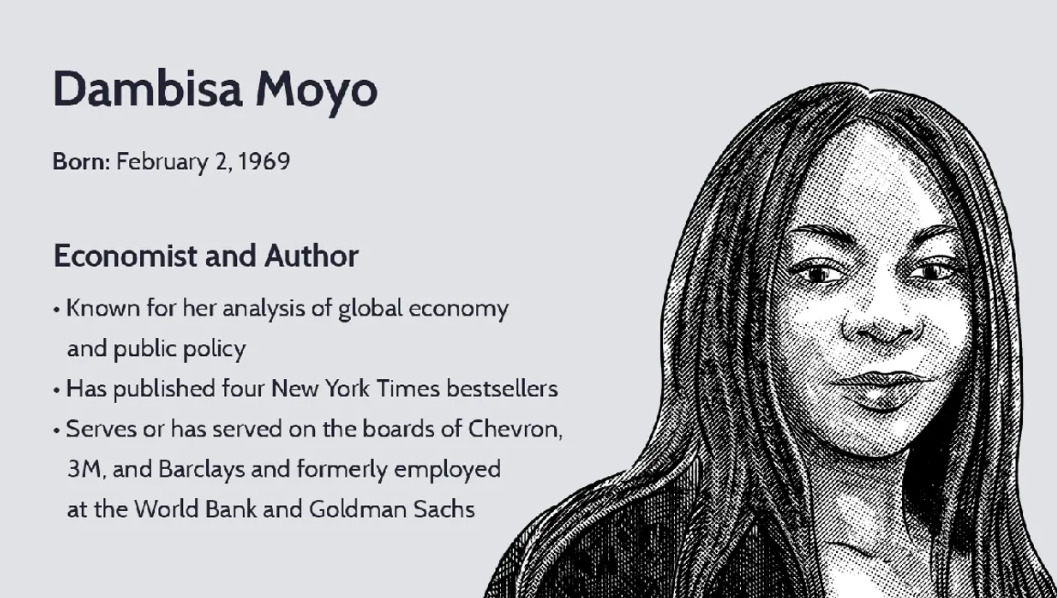

A sluggish economic climate is among the headwinds facing commercial real estate, writes Dambisa Moyo.

Commercial property has endured a torrid year, with US real estate investment trusts (REITs) declining more than 10% on average. In 2024, the sector still faces three undeniable challenges.

First is a refinancing risk of existing commercial real estate loans in the prevailing high-interest rate environment.

According to a report from Goldman Sachs in April 2023, the US commercial real estate sector faces nearly US$1.1trn (€1.0trn) of debt due to mature by the end of 2024. Meanwhile, Morgan Stanley estimates $1.5trn of US commercial real estate loans are due in the next three years.

With rates up over 500 basis points compared to March 2022, many landlords could struggle to refinance their debts and mortgages at the significantly higher prevailing interest rates cost.

Furthermore, if landlords find it difficult to refinance or repay their loans – this could create knock-on effects for the banks holding the loans and the possibility of widespread losses and systematic risks in the wider economy – that could require the government to step in and support the ailing sector.

Second is the financial “staying power” and the capital structure of the landlords. If for example, they are holding property assets using cash or equity, then the financial calculus will be stronger and less vulnerable to the cost of capital than if they have debt financed their property portfolio.

After all, if landlord balance sheets do contain debt, leverage should be constrained in a higher interest rate environment.

According to Goldman Sachs there is already caution within the property financing sector with average loan-to-value ratios for underlying loans falling to 51% in April 2023, down from the post-COVID average of 60%, Previously, many portfolios exceeded 75-80% LTVs when interest rates were at historic lows.

Meanwhile, rising interest rates have pushed up the cost of capital, with property owners seeking to refinance facing higher repayments, or even struggling to secure lending if they are highly levered.

Third is the persistently poor economic backdrop and its related impact on demand for commercial real estate. Growth is likely to remain weak, with the IMF having downgraded growth forecasts for 2024 for the US to just 1.5%.

Moribund economic growth has raised fears about demand for work space. Additionally, structural changes such as the working-from-home phenomenon means employers across the public and private sectors are recalibrating their real estate needs.

Some cracks are already starting to appear. US office vacancy rates have hit a 20-year high at 17.8% – up 1.5% year-on-year. Among the cities hardest hit are New York, Los Angeles and San Francisco, whose office vacancy rates stand at 22.2%; 35% and 22% respectively. LA and San Francisco vacancy rates are at historic highs.

Falling demand is adding a further pressure to the sector. Post-pandemic working practices appear to be entrenched and a report by McKinsey suggests demand for commercial real estate in so-called superstar cities will remain well below pre-pandemic levels.

In a moderate scenario, it believes demand for offices will be 13% lower in 2030 than in 2019 across nine major cities it studied, a figure which leaps to 38% for the most heavily impacted cities.

Clearly, there will always be dispersion in demand for assets. Traditionally, high-quality trophy assets – investment property in the top 2.5% by value, are seen as being more capable of retaining their value and eliciting demand regardless of the challenged macro environment.

However, even some trophy assets could face pressure in 2024.

In November Signa Holding, the central company of the property group that part-owns New York’s iconic Chrysler Building and other trophy assets, filed for administration under pressure of the increasing cost of servicing debt.

As more indebted owners face financial challenges in 2024, opportunities to acquire discounted or even distressed assets are likely to appear. However, investors considering committing capital to the sector will need to pay close attention to the long-term demand dynamics.

Many commentators believe the interest rate cycle is turning, which could help ease the challenging conditions for real estate. But even if that happens it only starts to fix one of the many problems that real estate investors face.

After all, commercial real estate will likely continue to be hit by a confluence of macro and market factors – from declining demand, scarce financing, and further falls in asset prices.