Erika Ayers Badan: You Are The Problem (And The Solution)

This is an episode for people grappling with how to manage and how to embrace AI. Good managers in the future will seamlessly balance being…

Thought Leader: Erika Ayers Badan

By Niall Ferguson

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” It was in a lecture delivered in London in 1970 that Milton Friedman uttered those famous words, the credo of monetarism. Over the previous five years, inflation in most countries had been on the rise.

In the first half of the 1960s, U.S. consumer prices had never gone up by more than 2% in any 12-month period. The average inflation rate from January 1960 until December 1965 had been just 1.3%. But thereafter it moved upward in two jumps, reaching 3.8% in October 1966 and 6.4% in February 1970.

For Friedman, this had been the more or less inevitable consequence of allowing the money supply to grow too rapidly. The monetary aggregate known as M2 (cash in public hands, plus checking and savings accounts, as well as money market funds) grew at an average annual rate of 7% throughout the 1960s. Moreover, as Friedman pointed out in his lecture, the velocity of circulation had not moved in the opposite direction….

Erika Ayers Badan: You Are The Problem (And The Solution)

This is an episode for people grappling with how to manage and how to embrace AI. Good managers in the future will seamlessly balance being…

Thought Leader: Erika Ayers Badan

Patrick McGee: Tesla’s Robotaxi Bait and Switch

Elon Musk called self-driving cars a ‘solved problem’ 10 years ago. So how come he’s still working on it? In a new column, Patrick McGee…

Thought Leader: Patrick McGee

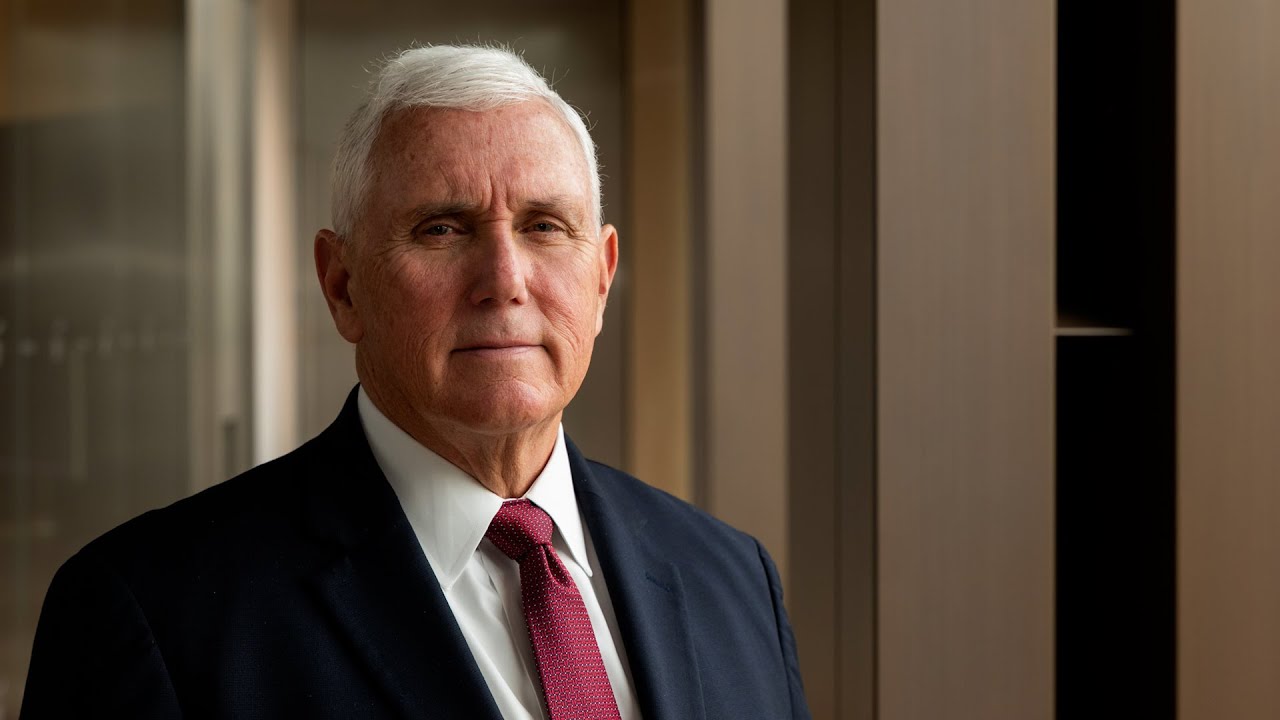

Mike Pence on U.S. Leadership and Global Strategy

Former Vice President of the United States, Mike Pence, shares his thoughts about President Trump’s framework on trying to acquire Greenland, and discusses what he…

Thought Leader: Mike Pence