Dr. Sanjay Gupta: A New Way to Heal

Doctors have long prescribed pills and procedures. But for some people, that isn’t enough. Sanjay sits down with Julia Hotz, author of The Connection Cure, to explore the…

Thought Leader: Sanjay Gupta

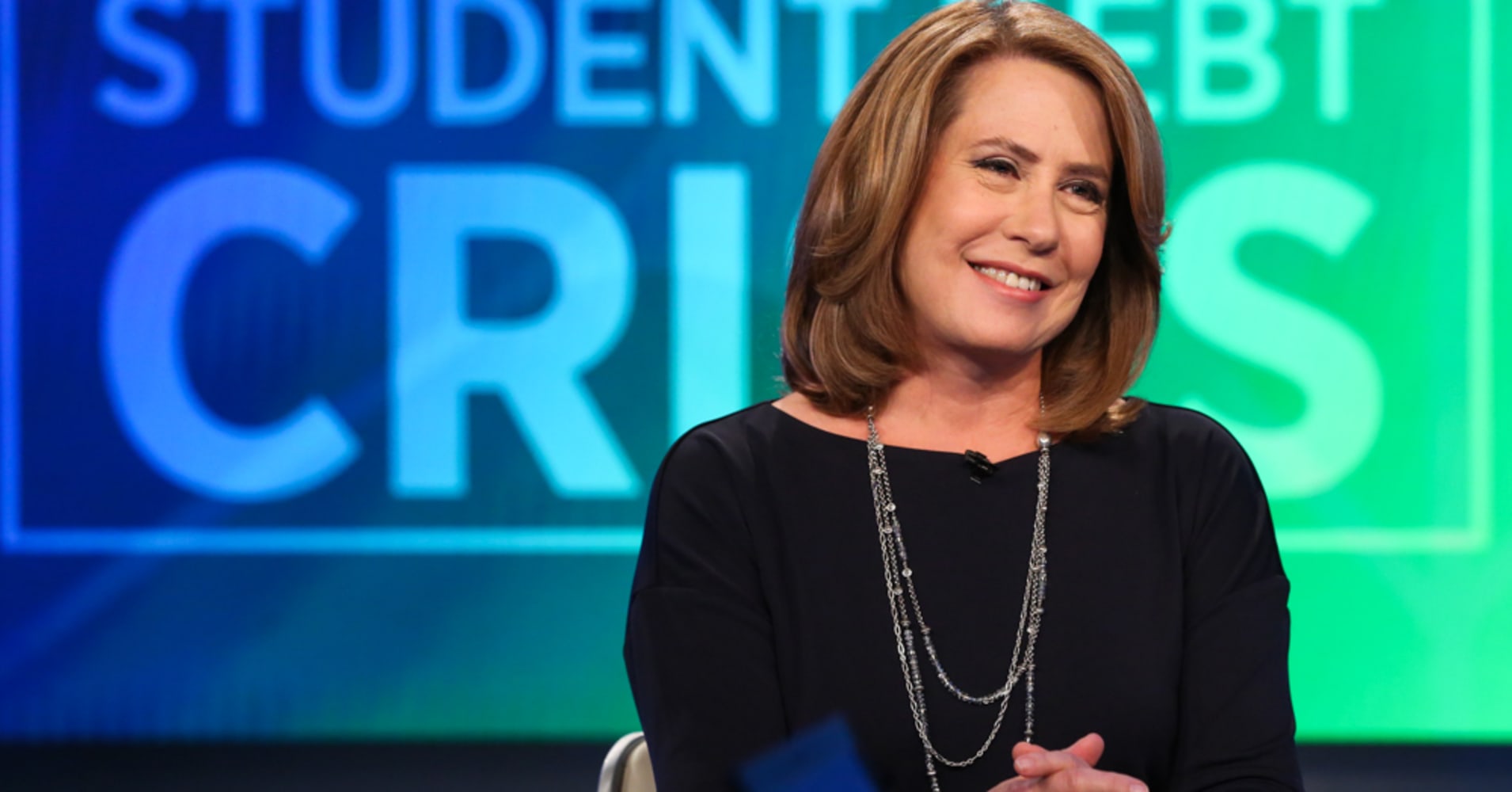

By Sheila Bair (original source Yahoo Finance)

“’Never let a good crisis go to waste,’ Rahm Emmanuel famously said in 2009. As President Obama’s Chief of Staff, he was speaking of the opportunity to achieve meaningful financial reforms in the aftermath of the Great Financial Crisis.

Ironically, big bank lobbyists are now using the Covid-19 crisis to undo those very reforms, cynically claiming deregulation will help banks support the real economy. Their primary target is the leverage ratio, a key measure of financial stability which big banks have long despised because it places hard and fast constraints on their ability to use unstable leverage to generate high returns. Weakening the leverage ratio will reduce the capital resiliency of the banking system, while giving banks incentives to actually reduce lending to artificially boost their capital ratios.

It is generally recognized that a main cause of the 2008-2009 financial crisis was excessive reliance on debt, or “leverage,” by large financial institutions. Central to post-GFC reforms was a strengthening of rules that require banks to fund themselves with a minimum amount of equity capital. There are two sets of requirements: “risk-based” rules which set minimum capital based on the perceived riskiness of a bank’s assets and “leverage ratios,” which do not allow such adjustments. A key disadvantage of risk based requirements is that they are subjective. They failed spectacularly prior to the GFC, when US and European regulators wrongly assumed mortgages and sovereign debt were low risk. The disadvantage of leverage ratios is that they are not risk-adjusted, requiring the same amount of capital against a US Treasury security (which we hope is safe) as a loan to Boeing. Each has strengths and weaknesses, which is why regulators use both.”

Click here to read more

Dr. Sanjay Gupta: A New Way to Heal

Doctors have long prescribed pills and procedures. But for some people, that isn’t enough. Sanjay sits down with Julia Hotz, author of The Connection Cure, to explore the…

Thought Leader: Sanjay Gupta

Niall Ferguson: Trump’s World Order Live From Davos

Live from Davos, Scott Galloway and historian Niall Ferguson examine why today’s geopolitical moment looks less like a “new world order” and more like a…

Thought Leader: Niall Ferguson

Mike Pence Talks Trump’s Foreign Policy

Former US VP Mike Pence discusses President Trump’s foreign policy with Greenland, Russia, and Ukraine. He says he commends President Trump on finding a framework…

Thought Leader: Mike Pence