Patrick McGee: China’s Robots vs. America’s Chatbots

In his latest article for The Free Press, WWSG exclusive thought leader Patrick McGee argues that the global AI competition isn’t just about building the…

Thought Leader: Patrick McGee

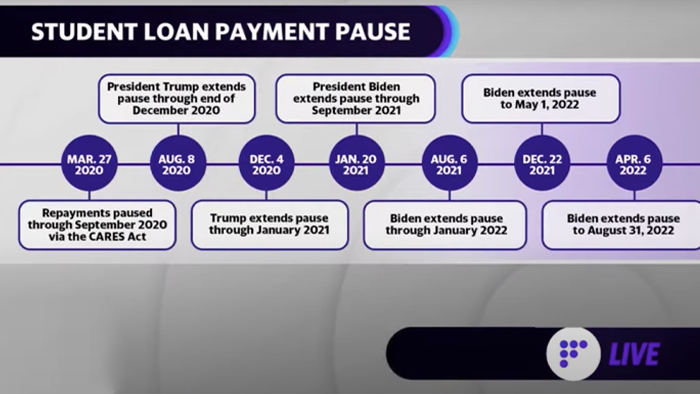

The expiration of the forbearance pause on federal student loans is fast approaching on August 31 — an impending economic hardship for many borrowers, according to one expert.

“Borrowers aren’t ready and servicers aren’t ready,” Sheila Bair, former FDIC chair and former president of Washington College, recently told Yahoo Finance Live (video above). “Borrowers haven’t had to make payments for well over two years. Their budgets have come to rely on not making those payments and you’re going to see some massive non-payment and delinquency rates go up and hurt credit scores.”

Federal student loan debt is around $1.7 trillion. Resuming student loan payments will put stress on personal budgets post-accommodations, averaging as much as $244 per borrower, according to a recent Equifax study. The study also found that credit scores are more likely to decline and that delinquency and defaults will resume, especially among younger borrowers with less credit history.

“The longer they’re in non-payment status, the harder it is to get a borrower to start paying again — the worse it is going to get,” Bair said. “This is one of the things we learned during the financial crisis when we were trying to get mortgage borrowers with reduced payments to start repaying their loans.”

Bair recommends income-driven repayment plans, which are more affordable than the standard 10-year repayment option that can be fairly high, too. The problem is that both repayment options accrue interest on the unpaid balance, sinking borrowers into more debt — as noted by tax lawyer and professor Dorothy A. Brown.

Another option to tackle the student debt problem is to put caps on the amount students can borrow. Those caps existed before 2007, but were increased due to rising tuition.

“There should be a limit on how much federal-subsidized, taxpayer-subsidized debt that can be taken out to cap the total amount that students can borrow,” Bair said. “[There should be] some accountability for schools to have loss sharing, pick[ing] up part of the cost if a lot of their students are in non-payment status.”

Schools are part of the problem, Bair said, especially for-profit schools that promised degrees using federal funds and were later shuttered for defrauding students.

“Kids are encouraged to take out this debt. Here’s your higher-ed opportunity and poor-quality schools have taken advantage of this,” Bair said.

The federal government is also at fault for failing to provide guidance not only on forbearance, but also on the public service loan forgiveness (PSLF) program which expires October 31, she added. With changes to loan servicers, many borrowers wouldn’t know who to make payments to.

“The lack of providing these borrowers clarity about what’s going on, they’re not prepared now and you’re going to have some negative impact on consumer-spending capability once these borrowers have to start making loan payments again, which in these inflationary times may not be a bad thing,” Bair said. “Any level of debt cancellation, if it’s just $10,000, is going to be far outweighed by that, so I wouldn’t worry about the macroeconomic impact. This really is about what’s good public policy for borrowers and taxpayers. And at this point, I think he’s got to extend the payment pause.”

Patrick McGee: China’s Robots vs. America’s Chatbots

In his latest article for The Free Press, WWSG exclusive thought leader Patrick McGee argues that the global AI competition isn’t just about building the…

Thought Leader: Patrick McGee

Dr. Sanjay Gupta: Why Does Everyone Have the Flu?

If it seems like everyone you know has the flu right now, you’re not that far off. The US has had a record-breaking flu season and isn’t over yet. With the…

Thought Leader: Sanjay Gupta

Lisa Bodell: Change Is a Choice

In this article, Lisa Bodell challenges the way we typically think about change. Rather than viewing it as a dramatic, all-or-nothing leap, she reframes change…

Thought Leader: Lisa Bodell