Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

US Treasury Secretary Scott Bessent has said he wants to deregulate the financial system responsibly. He has pointed to relief for community banks and other valid areas for reform.

Unfortunately, he has also floated a big bank priority: loosening limits on “leverage” — the ratio of bank’s debt to equity — and eliminating those restraints entirely for investments in short-term Treasuries. This would repeat regulatory errors that led to past financial crises, while giving banks powerful incentives to buy government debt at the expense of private sector lending.

Regulators have long sought to limit banks’ reckless use of leverage by requiring they maintain minimum levels of their own equity capital. They apply “risk-based” standards which vary capital minimums based on the perceived riskiness of different categories of assets, and a “leverage ratio” which is an overarching constraint on banks’ use of borrowed money.

Under risk-based standards, banks can boost their returns on equity by allocating capital to “safe” assets where regulators require lower levels of capital. Their ability to manipulate risk-based requirements, however, is constrained by the leverage ratio, which is neutral as to capital allocation.

While bank capital rules are supposed to keep the financial system stable, the risk-based rules have,- in the past, been a central cause of financial crises. This is because they encouraged banks to pile into activities that regulators (and the bank lobby) viewed as “low risk”, but in fact were anything but.

In her latest Financial Times article, former FDIC Chair Sheila Bair issues a sharp warning against weakening bank capital rules—arguing that such deregulation could repeat the very missteps that triggered the 2008 financial crisis. With decades of frontline experience navigating financial stability and reform, Bair offers a clear, authoritative voice on what truly keeps the banking system resilient. Her insights make her a powerful and timely keynote speaker for audiences focused on economic policy, financial risk, and regulatory foresight. Read the full article on the Financial Times. Bair’s speaking engagements are managed exclusively by WWSG. To host her for your events, contact us.

Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

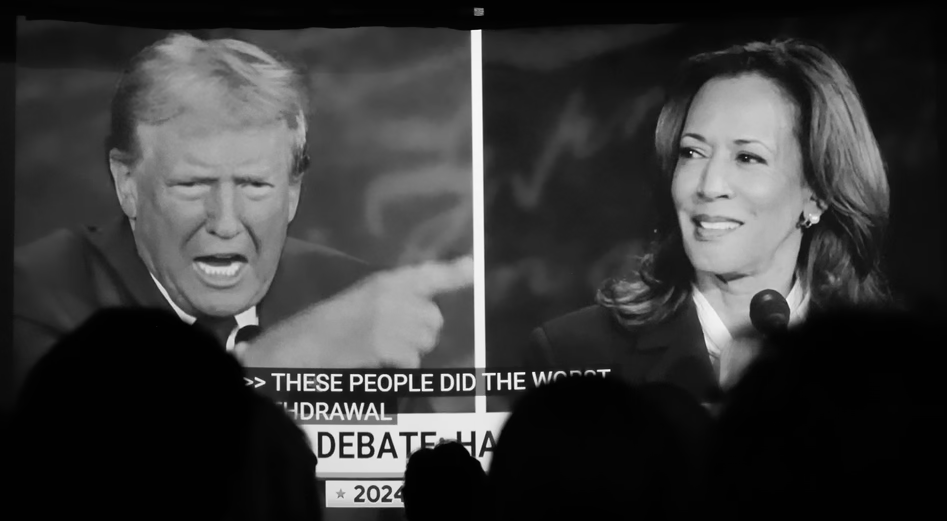

David Frum: How Harris Roped a Dope

This piece is by WWSG exclusive thought leader, David Frum. Vice President Kamala Harris walked onto the ABC News debate stage with a mission: trigger…

Thought Leader: David Frum

Michael Baker: Ukraine’s Faltering Front, Polish Sabotage Foiled, & Trump vs. Kamala

In this episode of The President’s Daily Brief with Mike Baker: We examine Russia’s ongoing push in eastern Ukraine. While Ukrainian forces continue their offensive…

Thought Leader: Mike Baker