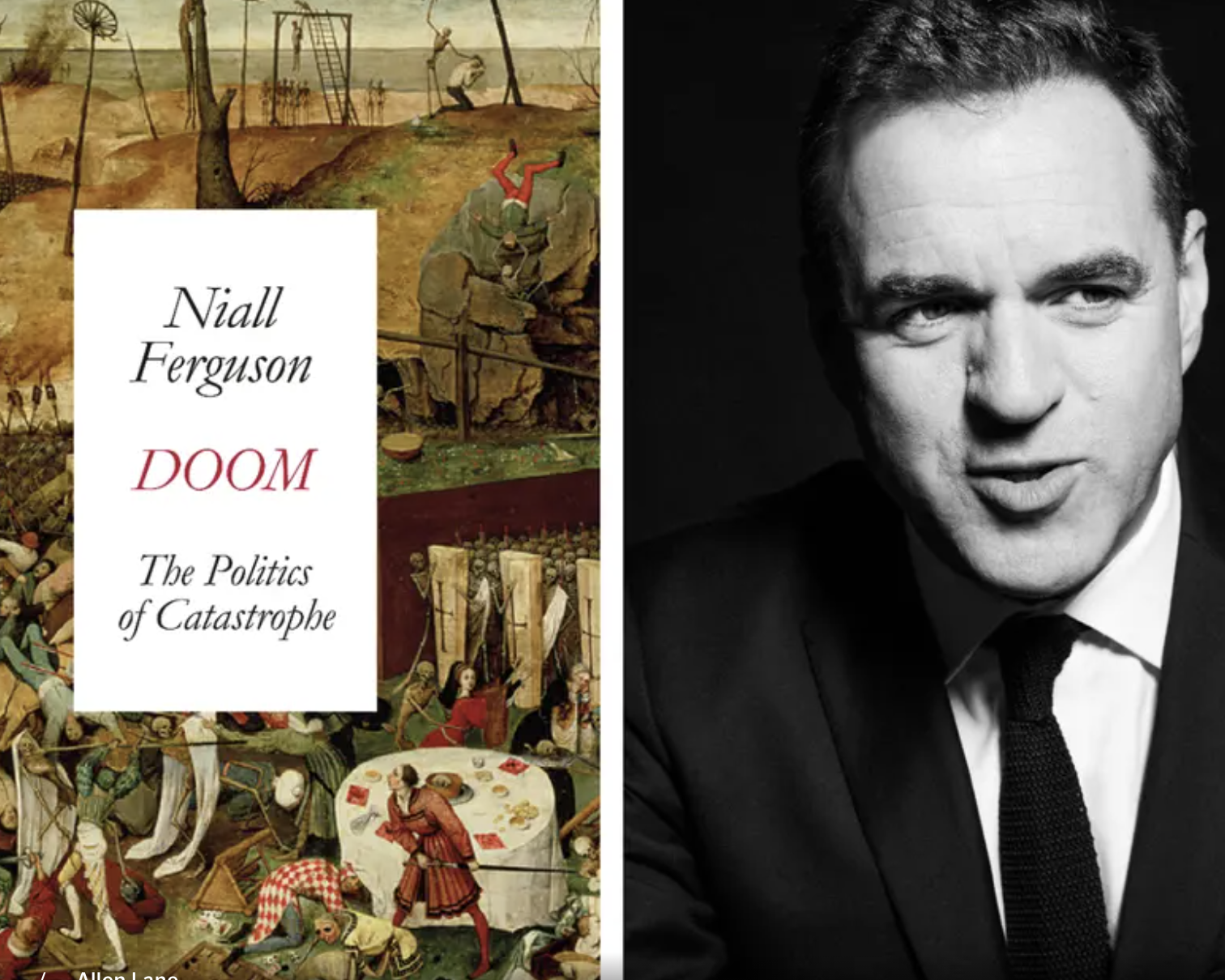

Doom: The Politics of Catastrophe by Niall Ferguson review

(Evening Standard) – From plagues and volcanic eruptions to the current Covid pandemic, mankind has always been faced with catastrophes.

Thought Leader: Niall Ferguson

Fans of Dr. Seuss will know by heart the key stanzas of Green Eggs and Ham.

Do you like

green eggs and ham?

I do not like them,

Sam-I-Am.

I do not like

green eggs and ham.

For those who have never had to read a bedtime story, allow me to explain. An irrepressible little creature, Sam-I-Am, spends the entirety of the book pitching green eggs and ham—on the face of it, an unappetizing dish—to a skeptical and increasingly irascible larger creature. With every page, the pitch grows more elaborate. Would you like them on a boat? With a goat? In the rain? On a train? Surely, there must be some context in which green eggs would be appealing fare. By the time Sam prevails, his hapless victim inhabits a scene of chaos.

When you come to think of it, there is often someone called Sam trying to sell you something you don’t initially want. In the 1920s, as I learned from Andrew Ross Sorkin’s 1929: Inside the Greatest Crash in Wall Street History—and How It Shattered a Nation, it was Sam Crowther’s article, “Everybody Ought to Be Rich”—exhorting housewives to buy stocks with margin credit. A few years ago, it was Sam Bankman-Fried with his crypto exchange, FTX. At the height of his fame, Bankman-Fried declared, “I want FTX to be a place where you can do anything you want with your next dollar. You can buy bitcoin. . . . You can buy a banana.” And you could also have bought green eggs and ham—until FTX blew up and Sam landed in prison.

A lot of the applications of generative artificial intelligence remind me of green eggs and ham. Take OpenAI’s Sora 2.0. With a few prompts, you can generate soft-porn videos of scantily clad girl manga elves. This is also one of the ways Elon Musk tries to sell xAI’s Grok. But why would I want to watch such videos, any more than I want to eat green eggs and ham?

Financial history can help us here. If you’re unsure if there’s an AI bubble, refer to the historian Charles Kindleberger’s five-stage model:

Displacement: Some change in economic circumstances creates new and profitable opportunities for certain companies.

Euphoria or overtrading: A feedback process sets in whereby rising expected profits lead to rapid growth in share prices.

Mania or bubble: The prospect of easy capital gains attracts first-time investors and swindlers eager to defraud them.

Distress: The insiders discern that expected profits cannot possibly justify the now-exorbitant price of the shares and begin to take profits by selling.

Revulsion or discredit: As share prices fall, the outsiders stampede for the exits, causing the bubble to burst altogether.

We are currently at stage 3.

To read the rest of this article now, go to: Niall Ferguson’s Substack.

WWSG exclusive thought leader Sir Niall Ferguson is one of the world’s foremost historians of economics, international relations, and global power. His incisive analysis illuminates the geopolitical forces and economic undercurrents shaping the 21st century. From great power competition to emerging security challenges, Ferguson offers unparalleled historical context and strategic insight — helping global leaders, policymakers, and business executives anticipate what lies ahead. To invite Sir Niall Ferguson to your next event, contact WWSG

Doom: The Politics of Catastrophe by Niall Ferguson review

(Evening Standard) – From plagues and volcanic eruptions to the current Covid pandemic, mankind has always been faced with catastrophes.

Thought Leader: Niall Ferguson

One reason so many are quitting: We want control over our lives again

The pandemic, and the challenges of balancing life and work during it, have stripped us of agency. Resigning is one way of regaining a sense…

Thought Leader: Amy Cuddy

Scott Gottlieb: How well can AI chatbots mimic doctors in a treatment setting?

This is an Op-ed by WWSG exclusive thought leader, Dr. Scott Gottlieb. Many consumers and medical providers are turning to chatbots, powered by large language…

Thought Leader: Scott Gottlieb