Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

President Donald J. Trump and the Republicans have an enormous opportunity to get government spending under control, cut waste and fraud from our health care system, and move toward a balanced budget.

This historic opportunity is created in part by former President Joe Biden’s unpopular overspending and emphasis on projects and programs the American people deeply oppose.

It is also created by the way the 2017 tax cuts were written. If they are not extended, there will be a huge tax increase for most Americans. A “no” vote to extend the tax cuts will be a vote to increase taxes. Increasing taxes is almost always politically dangerous.

The third great contribution to the budget effort is Robert F. Kennedy Jr.’s concept of Making America Healthy Again. Health care spending represents nearly 18 percent of the GDP. There is more than enough bad spending to save hundreds of billions of dollars without endangering Americans’ health care.

Citing Government Accountability Office estimates, Institute for Public Policy Research President John Goodman reported there were “$236 billion in improper payments during 2023, including $175 billion in overpayments – $1.75 trillion over 10 years.” GAO estimates also include “$233 billion to $521 billion lost to fraud – $2.3 trillion to $5.2 trillion over ten years.”

Simply cutting the fraud in half (which would still be vastly more than credit card companies or banks tolerate) would save well over $1 trillion – and maybe $2.6 trillion over 10 years. However, it would require replacing the current system with a modern system of real time information flow.

The greatest breakthrough may be the dramatic shift in the American people’s attitudes toward waste in government and government spending. Dave Winston and Myra Miller at the Winston Group startled me with their recent report on Americans’ attitudes toward cutting government spending. It reminded me of the strong support we received from the American people for welfare reform and balancing the budget in 1996. When we reformed welfare, half the Democrats (101 to 101) voted for it because the voters back home supported it so strongly.

The Winston Group made a series of important findings after running focus groups and a survey of 1,200 registered voters in January:

“1.) Inflation was the construct by which people viewed the economy and taxes. As a result, the most important personal outcome from tax policy was helps you deal with inflation and high

prices in your household budget (mean 7.52 on a scale of 1-9 with 1 being not important at all and 9 extremely important), followed by creating economic growth (7.39) and greater ability to save for the future and retirement (7.38).

“2.) In terms of debt solutions, spending cuts and tax increases are not on equal footing. Voters want government spending to be addressed first, as they do not believe they should be penalized for the government’s overspending. As one voter in our focus groups said, ‘The government needs to look at its own spending. That’s the common denominator here. Every single year they are in a deficit. … It’s not the taxpayers’ burden anymore. We’re the ones giving them the money, and they are the ones not handling it correctly.’ Voters have not ruled out tax increases, but this is seen as a last resort rather than first option, creating an uphill battle for proponents of tax increases.

“3.) In a direct choice, government spending was overwhelmingly seen as a bigger problem (76%) than not enough revenue coming in from taxes (16%). This is the case across party (Republicans: 89-7; Independents 77-15; Democrats 63-27).”

This reflects deep frustration with government mismanagement – and fear of huge deficits and national debt unlike anything we have seen in the last 30 years. The Winston Group’s data mirrors results we have found at America’s New Majority Project. According to our polling, 68 percent support making the 2017 Tax Cuts and Jobs Act permanent. Seventy-seven percent support shielding the middle class and small businesses from the scheduled tax hikes.

This frustration will only grow if Congress decides to let the 2017 tax cuts lapse. The Ways and Means Committee estimates the average American taxpayer would see an immediate 22 percent tax increase if the tax cuts are not extended. Median income households making $80,610 would pay $1,695 more in taxes. As the committee reported, “This is worth about nine weeks of groceries to a typical family of four across the country.”

So, the country wants a healthy budget that cuts spending, eliminates fraud and waste in the health system, and continues the 2017 tax cuts to avoid tax increases.

This is a remarkable moment for President Trump and the Republicans. It could lead to a surprisingly bipartisan bill if Congress listens to the American people.

Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

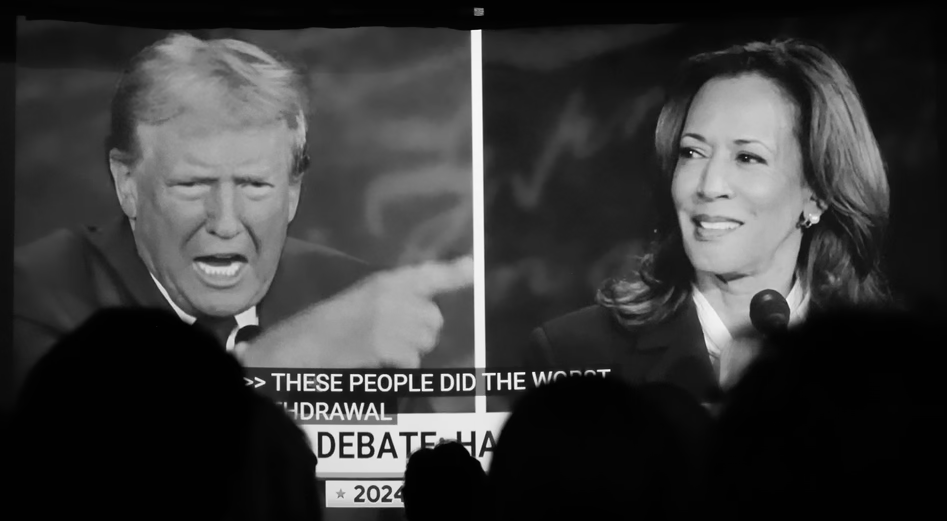

David Frum: How Harris Roped a Dope

This piece is by WWSG exclusive thought leader, David Frum. Vice President Kamala Harris walked onto the ABC News debate stage with a mission: trigger…

Thought Leader: David Frum

Michael Baker: Ukraine’s Faltering Front, Polish Sabotage Foiled, & Trump vs. Kamala

In this episode of The President’s Daily Brief with Mike Baker: We examine Russia’s ongoing push in eastern Ukraine. While Ukrainian forces continue their offensive…

Thought Leader: Mike Baker