Erika Ayers Badan: You Are The Problem (And The Solution)

This is an episode for people grappling with how to manage and how to embrace AI. Good managers in the future will seamlessly balance being…

Thought Leader: Erika Ayers Badan

(Original source Los Angeles Times)

“As central bank governors, Federal Reserve officials, economists and reporters convene for the annual economic policy retreat in Jackson Hole, Wyo., this weekend, the question on everyone’s mind is: Will the Fed raise interest rates come September?

The answer should clearly be “no.” The preponderance of economic data indicates that the predictable costs of premature tightening — slower job and wage growth — far outweigh the risk of accelerating inflation.

Six years into a lackluster U.S. expansion, price growth for personal consumption expenditures — excluding food and energy — has averaged less than 1.5% annually in the recovery, well below the Fed’s unofficial 2% inflation target. It slowed to 1.3% so far in 2015.”

Click here to read more

Erika Ayers Badan: You Are The Problem (And The Solution)

This is an episode for people grappling with how to manage and how to embrace AI. Good managers in the future will seamlessly balance being…

Thought Leader: Erika Ayers Badan

Patrick McGee: Tesla’s Robotaxi Bait and Switch

Elon Musk called self-driving cars a ‘solved problem’ 10 years ago. So how come he’s still working on it? In a new column, Patrick McGee…

Thought Leader: Patrick McGee

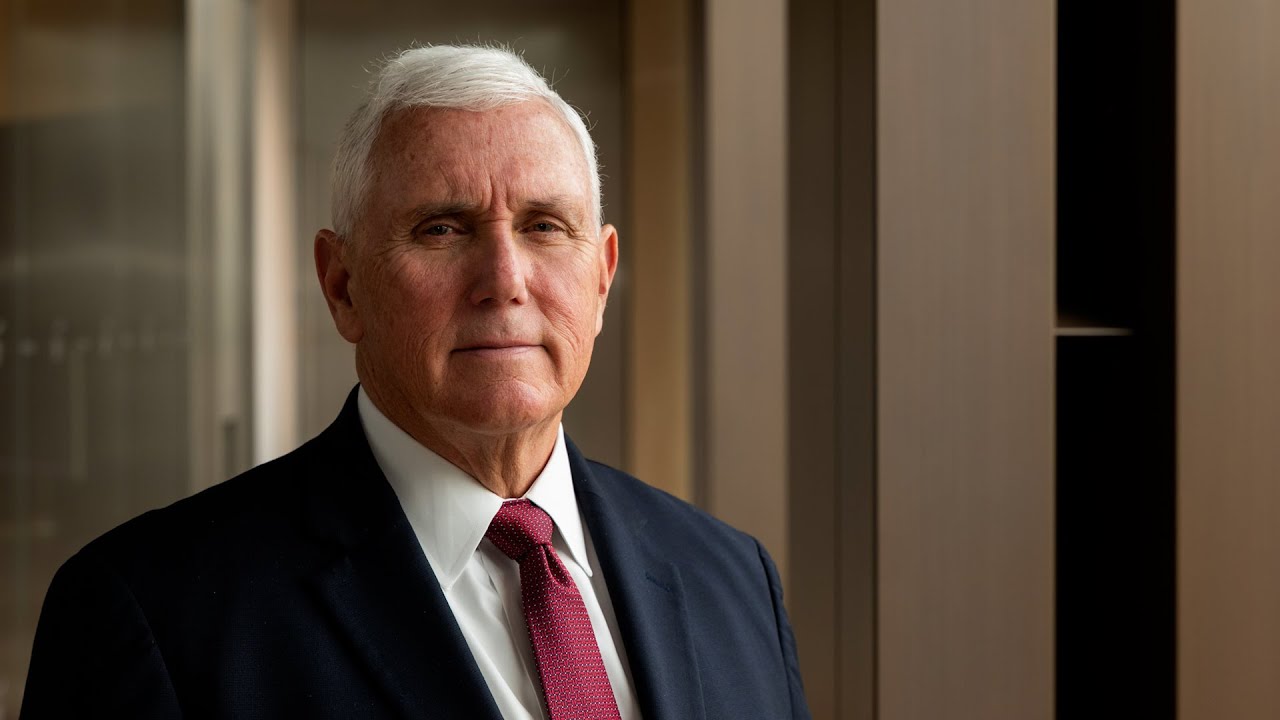

Mike Pence on U.S. Leadership and Global Strategy

Former Vice President of the United States, Mike Pence, shares his thoughts about President Trump’s framework on trying to acquire Greenland, and discusses what he…

Thought Leader: Mike Pence