Peter Goodman: His Start-Up May Not Survive Trump’s Tariffs

A sourdough baker turned entrepreneur in North Carolina has delayed his new product as he contemplates the prospect that higher costs will doom his company.…

Thought Leader: Peter Goodman

(Original source Financial Times)

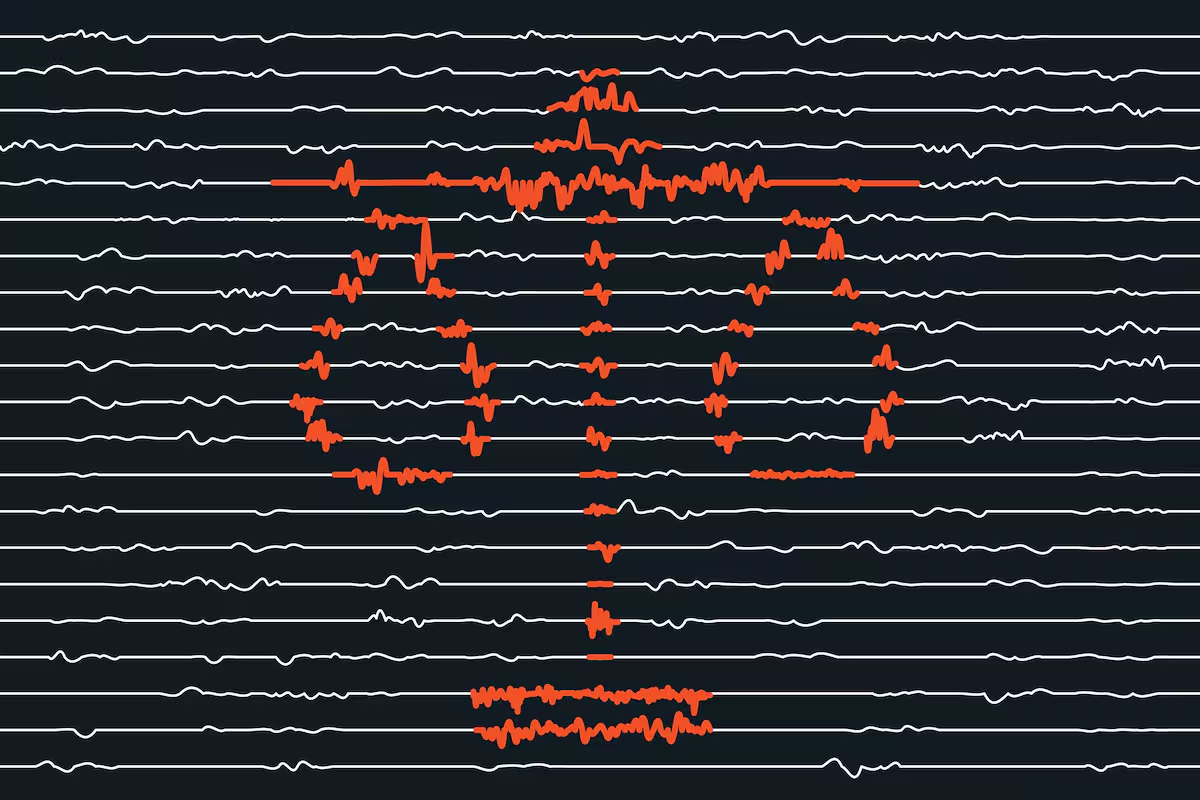

“As I was growing up, my Depression-era parents always preached the importance of having a rainy-day fund to deal with the economic hardships life inevitably throws at you, such as job loss or illness.

Later, as a bank regulator, I valued the similar funds banks set aside to cover losses they would invariably incur on some loans. Unfortunately, in the lead up to the 2008 financial crisis, those funds — called loan loss reserves — were woefully inadequate primarily because of accounting constraints that some bankers rightfully complained about at the time.

But now that accounting standard-setters are trying to improve those rules, industry lobbyists want Congress to help them preserve the status quo.”

Click here to see more

Peter Goodman: His Start-Up May Not Survive Trump’s Tariffs

A sourdough baker turned entrepreneur in North Carolina has delayed his new product as he contemplates the prospect that higher costs will doom his company.…

Thought Leader: Peter Goodman

Tony Abbott calls for stronger action to end ‘pro-Hamas’ protests

Former prime minister Tony Abbott has called for stronger action on antisemitism in the wake of further attacks against the Jewish community, including tougher policing…

Thought Leader: Tony Abbott

Leana Wen: The Doctor Will See You Now. So Will the Lawyer.

Legal aid organizations are helping doctors address social barriers to patients’ health. During my residency training, when I worked shifts in the pediatric emergency department,…

Thought Leader: Leana Wen