Peter Zeihan: Europe Goes Nuclear

We’ve got two major developments in Eurasia. We’re talking about Ukraine disabling two ships in the Caspian Sea and Poland getting EU approval to build…

Thought Leader: Peter Zeihan

The real estate industry, known for its complexities and challenges, is undergoing a significant transformation in the wake of the COVID-19 pandemic and shifting macroeconomic conditions. Amidst the pressures of housing affordability, work from home (WFH), and sustainability demands, real estate owners and property managers are seeking innovative solutions like artificial intelligence or AI. In this chaotic landscape, venture capitalists are funding AI and real estate technology (proptech) to attack the problems and provide a road to the future.

Recognizing the gold mine of data within the industry, venture capitalists are spearheading efforts to systematize, structure and optimize the treasure trove of information. The resulting algorithms and products hold the key to long-term competitiveness in the real estate industry. By leveraging AI tools, market efficiency and outcomes can be improved for stakeholders across the entire real estate ecosystem, including buyers, sellers, brokers, and governments. Moreover, private capital is fueling the development of products that have the potential to democratize real estate investing, benefiting a broader range of individuals.

Traditionally characterized by manual workflows and limited access to data-driven insights, the real estate industry is undergoing a paradigm shift with the integration of AI, or proptech. This article will explore the intersection of real estate and AI, uncovering the transformative impact on property valuation, transaction efficiency, affordable housing initiatives, resource optimization, and the potential for a more decentralized real estate sector. Through this exploration, we’ll show how AI in real estate is revolutionizing how the industry operates, paving the way for a more innovative, efficient, and inclusive future in the industry.

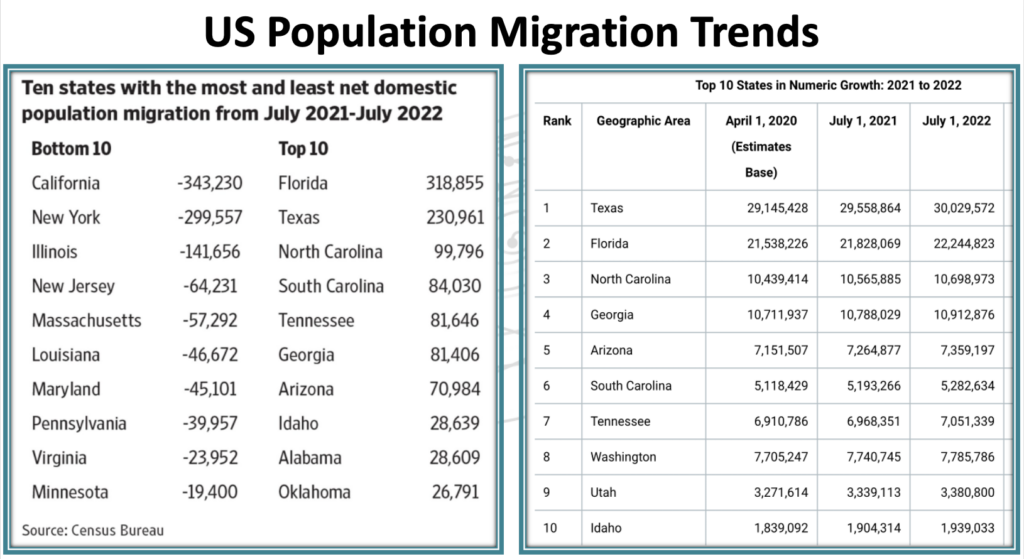

Before diving into the companies and investments driving change, let’s take a quick look at the drivers of the real estate sector. COVID has driven significant change to where people live and work habits. The Census Bureau created research showing the internal migratory patterns of US citizens since the summer of 2021. It is simply astonishing the rapid shift away from large northern states to southern states. The table below shows the shift.

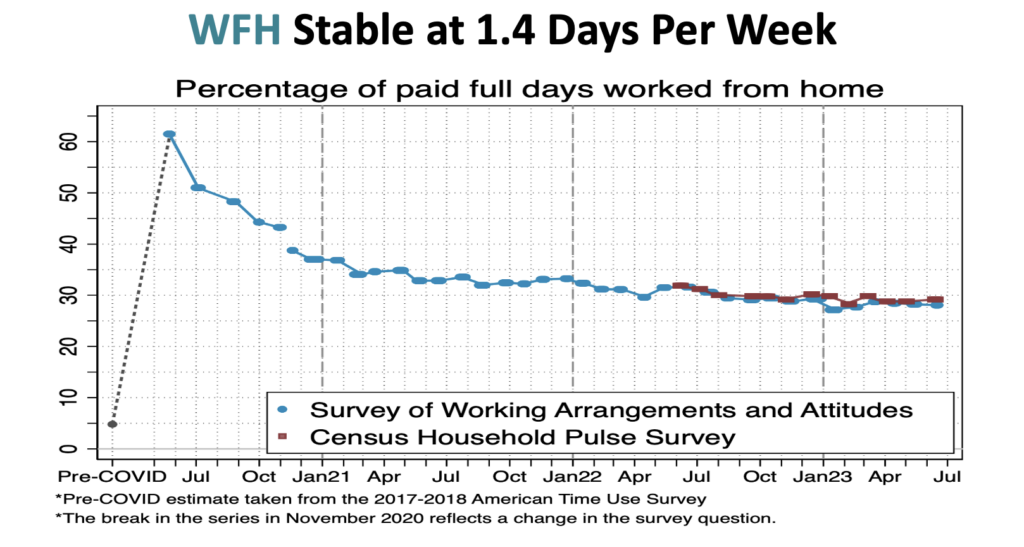

The chart below shows a survey on how Americans view work from home (WFH) or remote work. Currently, the data indicates a consistent average of 1.4 days per week spent working remotely. If this trend continues, it is likely to have substantial implications for the demand in business district office space. Moreover, other commercial properties, including co-working spaces and suburban office complexes, may also witness changes in demand due to the rising popularity of remote work. Consequently, the cumulative effect of these shifts could lead to downward pressure on real estate prices.

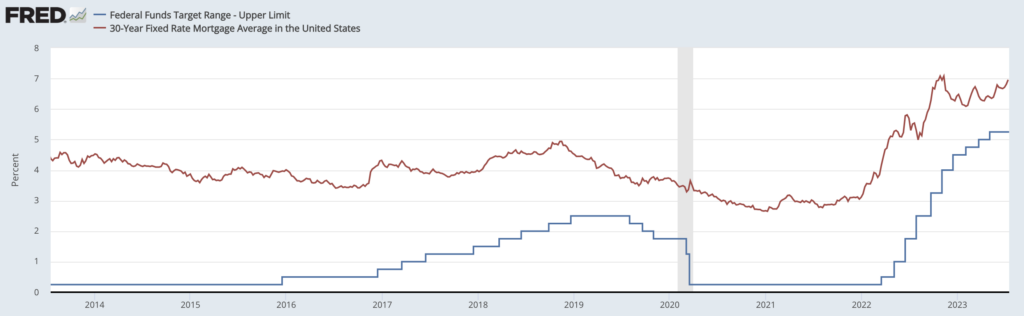

Another critical factor stands out: the era of cheap money is over. Rapid inflation drove central banks around the world to raise rates at a breathtaking pace. In the United States, the Federal Funds rate went from 0 to 5.25% in less than 14 months after hovering near zero for two years. Over that same period, the average 30-year fixed mortgage rate has doubled.

While the Federal Reserve maintained short-term interest rates at zero and expanded its balance sheet from $4 trillion to $9 trillion, US real estate prices surged by an impressive 45%, as indicated by the S&P Case Shiller National Home Price Index. However, the simultaneous rise in both real estate prices and interest rates placed a considerable strain on consumers’ purchasing power. Consequently, the industry experienced a notable slowdown in transaction volumes.

Nowadays, real estate owners and managers find themselves grappling with a crucial question: how can they maintain satisfactory returns amidst the ongoing increase in capital costs? The answer lies in the need to adapt and become more efficient while cutting down on expenses. By streamlining operations and finding ways to reduce costs, they can navigate the challenges imposed by higher interest rates and continue to deliver positive results in a changing economic landscape.

Proptech VC investments reflect the new macroeconomic reality. Start-up companies in the real estate sector attracted total funding of nearly $20 billion in 2022, a steep drop from the $32 billion the sector received in 2021 when prices were soaring and capital was cheap. The next few years are likely to see a thinning of proptech companies working on AI models and products that serve the real estate industry as profitability has declined. However, instead of trimming technology budgets, sharp investors and firms are likely to increase funding on AI investments today that will pay off over the next 5-7 years.

Established industry players are already integrating AI into their businesses to stay ahead. Redfin, for instance, uses AI tools to augment their human agents by automating matchmaking between buyers and sellers and streamlining customer relationship management. Meanwhile, Zillow, a competing property website, is training an AI model that can better integrate digital photos into property value estimates.

Even Walker & Dunlop, a publicly-traded commercial real estate developer with over $1 billion in annual revenue, spent $85 million to acquire real estate analytics firm Geophy last year, showcasing their commitment to leveraging AI for competitive advantage.

Movements from larger players underscore key themes of AI in real estate. Some of the themes are consistent across economic sectors, such as the ability of AI models to automate manual processes and enhance productivity. Others will be unique, like the development of new property valuation models. While larger players are making strides, the most disruptive innovations in real estate AI are expected to come from proptech start-ups. These agile companies are poised to transform the industry by automating manual processes, enhancing productivity, and developing new property valuation models. Using venture capital investments as our guide, let’s look at some of the major contributions that AI and proptech start-ups will make to the real estate industry.

Accurately valuing a property is the backbone of a real estate transaction. Yet current valuation processes are mired in manual processes that can quickly balloon costs in the best of times. The outlook for the next decade promises to be even more complex, as property prices adjust to generational shifts in societal work habits and the highest interest rates in 20 years. Real estate investors are being asked to evaluate the unprecedented and unexpected, and this is almost impossible using the traditional method of evaluation.

Traditionally, valuing a property required extensive manual analysis using comparative modeling based solely on location transactions, often leading to lengthy and subjective processes. However, with the advent of automated valuations models (AVMs) powered by artificial intelligence (AI), property valuation has become faster, more accurate, and cost-effective. These AI-driven models leverage vast amounts of data, including historical sales records, interest rates, migratory patterns, property characteristics, and market trends, to generate reliable and data-driven property valuations. This not only expedites the transaction process but also reduces costs and minimizes human bias.

Office space provides the most dramatic example. Some 10-20 percent of the current square footage will likely need to be removed or repurposed given a permanent shift to hybrid work. The loss of tenants impacts building owners and managers directly. In addition, sparsely populated urban centers reduce the prospects for restaurants and other vendors who relied on commuters five days per week. We know there is already an impact on the commercial property market, but sorting out the true market signals from the noise will be challenging in the months and years ahead. To be ahead of the curve, many venture capitalists are betting that highly trained algorithms will be able to provide insights better than humans alone.

Collectively, the top three developers of Automated Valuation Models (AVM) and other real estate data platforms powered by AI have hauled in over $120M in funding over the last two years. Each of the companies offers its own unique twist by catering to specific market segments. However, they all share a similar goal of conducting real estate valuations faster, cheaper, and more accurately. When AI models can process millions of data points efficiently and conduct virtual property appraisals, the human element of “gut feel” from industry veterans will likely diminish.

Consider HouseCanary ($65M Series C 2020), whose data analytics and property valuations are like Zillow and Redfin on steroids. The company’s residential property value estimates draw on an enormous range of variables, accounting for factors such as market volatility, local incomes and wage growth, and just about anything else under the sun that may influence home prices. Predictive forecasts that can stretch as far as three years into the future are where the platform truly seems to shine. Mortgage lenders and other financial institutions are among the customers, with a clear goal of supercharging the appraisal and underwriting process.

The AI-powered platform from Cherre ($50M Series B 2021) offers similar services targeting investment and fund managers. The company boasts that its systems make “faster, smarter decisions” through tailored reporting and analysis. Cherre offers a data portal that can serve as the single source of truth for real estate professionals. By reducing manual collection processes, the company hopes to increase data accuracy, accelerate reporting cycles, and provide enhanced insights across real estate portfolios.

Finally, Plunk ($6.5M Seed 2021) is focused on building a dynamic AVM that can adjust in real time. By harnessing the power of AI models, which learn and improve continuously, the company hopes to provide investors and homeowners with up-to-the-minute insights into expected returns on real estate decisions. A more precise understanding of how a remodel or addition will impact home values would be a huge boon to consumers who are considering shelling out significant sums for home improvement.

All AVMs are built on the ability of AI computing models to vastly improve data collection and analysis. AI models can draw on a multitude of public and private sources, while quickly cross-referencing property features against huge databases. The ability of humans to conduct similar research – which typically involves identifying suitable property comparisons, sifting through detailed records, and making in-person site visits – pales in comparison. The time required for humans to assess a property and evaluate fair market value also involves direct labor costs. In addition, firms incur opportunity costs as capital is tied up in escrow or committed to a project that takes an extended period to close. AI models may not fully overcome market inefficiencies in real estate. But by increasing the speed and accuracy of valuations, they will help make significant progress.

Furthermore, property appraisers will not be the only beneficiaries as AVMs scale and improve. AVMs have found applications in insurance underwriting, where they assist in assessing property risks and determining appropriate coverage. These attributes will be all the more important as climate change increases the likelihood of extreme weather events and natural disasters. ZestyAI ($33M Series B 2022) specializes in using AI models to help accurately evaluate climate risks for property owners. For example, the firm’s Z-FIRE product is an AI model of trained self-learning algorithms that use aerial imagery to recognize wildfire risk factors. By leveraging the power of AI, AVMs are transforming the way properties are valued, providing greater efficiency and accuracy to the real estate industry and insurance sector alike.

Affordability is another chronic issue in the real estate market. Across the developed world, constrained housing supply and rising populations are leading to upward pressure on prices without commensurate gains in wages. About half of Americans view the lack of affordable housing as a problem in their community, yet the roadblocks to home ownership have shown few signs of abating. Regulations and permitting issues continue to extend project completion timelines, while inflation continues to hammer construction costs. More housing stock is desperately needed – and quickly.

Several AI software developers view the acute need as a business opportunity. Venture capital backers agree. From optimizing site selection to streamlining the permitting process, new AI computing models are being applied to each phase of real estate development and construction.

Start with site selection. Many cities feature underutilized space waiting to be discovered. The data even tends to be publicly available. But good luck finding it. Accessing zoning and land use data requires navigating archaic government websites and sifting through county assessor records. Data is often fragmented, incomplete, or outdated. Searching for the hidden treasure of promising investment opportunities takes time, effort, and resources. But the founders of CityBldr ($4.3M Seed 2018) and Deepblocks ($2M Convertible Note 2023) are harnessing the power of AI to vastly simplify the site selection process. Their software serves as the digital equivalent of an advanced, interactive treasure map. Instead of a simple “X”, users enjoy the use of advanced search and filter capabilities to quickly access critical site selection information. Parcel size, location, zoning restrictions, and current population capacity are all at their fingertips.

CityBldr describes its software as the “Rosetta Stone of zoning.” Their proprietary database includes 100 U.S. cities with 255 different zoning standards. The scope and reach available at the click of button dwarfs human abilities, where detailed zoning expertise is typically limited to a handful of markets. This type of granular insight into site development possibilities can be particularly useful during periods of significant disruption, like the aftermath of COVID-19. Assessing development opportunities on a large scale is possible because AI algorithms can quickly integrate new findings and approaches from other cities. Pioneering approaches in one city can quickly spread to others with the help of AI models. Furthermore, local governments may also be able to glean fresh insights into their space from the refinement of these tools. Not just private developers, but also local governments pursuing affordable housing public policy objectives.

Another promising AI model aims to accelerate the construction planning and permitting process. Swapp ($11.5M Series A 2023) uses generative AI – the same technology behind ChatGPT – to create architectural planning documents in minutes. The company claims to have achieved 75% cost savings and sped up project timelines by 3x. If the technology is successful, it could be used by both the regulated entity and regulators. Imagine the workload relief at the local planning department if AI models could help generate regulatory decisions and evaluate permit applications.

Finally, real estate AI technology is being applied to expedite deal closing times and reduce transaction costs. Keyway ($25M Series A 2022) uses AI systems to underpin their end-to-end technology platform tailored for real estate deals under $20 million. Their standard product enables an efficient sale-leaseback for small business owners, allowing customers to sell their property for the full value while remaining in the same location with a long-term lease. Keyway’s technology platform provides digital contract management services to expedite closing.

Improvements in each phase of the real estate development and transaction processes add up to substantial savings in time and money. By serving both private and public sector companies, AI proptech firms will help address the affordability crisis plaguing so many urban centers today.

The final category of compelling AI and proptech start-ups is focused on smart building management. Buildings of all types suck up energy and water resources for their inhabitants, a fact long recognized by real estate owners and property managers. The Leadership in Energy and Environmental Design (LEED) program was designed to help set the standard for environmentally-friendly building designs.

Now, AI start-ups are hoping to help property managers raise the bar for “green” buildings around the world. AI has been a driving force behind sustainability efforts in real estate, optimizing resource consumption and reducing environmental impact. Smart building management systems equipped with AI algorithms enable precise energy management, monitoring, and control within buildings. These systems analyze energy usage patterns and make real-time adjustments to optimize efficiency and reduce waste. In addition, smart building management systems can help real estate owners remain in the good graces of regulators and capital markets. Policymakers and investors are demanding even more environmental and sustainability actions from all sectors, and real estate is no exception.

In addition to environmental benefits, smart building management systems offer other advantages for the real estate sector. For starters, they help reduce operating costs. More efficient use of inputs, plus better financial planning through predictive maintenance, leads to real cost savings. Reducing operating costs is especially critical during periods of high-interest rates, as mortgages and other forms of debt financing become relatively more expensive.

Another critical advantage is that it enhances occupant comfort and productivity. Smart systems optimize indoor conditions, such as air quality, temperature, and lighting, based on occupancy patterns and user preferences. This improves occupant comfort, well-being, and productivity. It is important given new working patterns. The improvement in comfort and well-being will make people enjoy coming to the office, and consequently enhance productivity.

Smart building management systems also help with predictive maintenance. The AI algorithms analyze data from sensors to detect equipment anomalies and predict maintenance needs. Proactive maintenance minimizes downtime, extends equipment lifespan, and reduces repair costs.

Lastly, they help with future-proofing. Implementing smart building management systems prepares properties for future advancements in technology and ensures adaptability to evolving industry standards.

Here are two examples of companies receiving venture capital funding in this space. Based in Atlanta, Facilio ($35M Series B 2022) is a management software that employs IoT and machine learning to help manage buildings operations, maintenance, and sustainability. Measurable.energy (£4.5M Series A 2023) is a machine learning and hardware platform to eliminate wasted energy and GHG emissions in buildings.

AI is transforming the way customers interact with real estate companies. AI-driven chatbots and virtual assistants are improving customer support by providing instant responses to inquiries and offering personalized assistance throughout the property search and transaction processes. These chatbots can handle a wide range of queries, from property information to financing options, ensuring that customers receive prompt and accurate information at any time.

Furthermore, AI algorithms are revolutionizing property recommendations. By analyzing user preferences, search history, and demographic data, AI systems can provide customized property suggestions that align with the individual needs and preferences of potential buyers. This not only saves time but also enhances customer satisfaction by delivering highly relevant options.

In addition, virtual reality (VR) and augmented reality (AR) technologies are transforming the property viewing experience. Buyers can now take virtual property tours from the comfort of their homes, exploring every room and detail as if they were physically present. This technology has proven particularly useful during the COVID-19 pandemic, as it allows buyers to make informed decisions without compromising their safety or travel plans.

While AI brings numerous benefits to the real estate industry, it also raises concerns regarding data security and ethical considerations. Collecting and processing large amounts of personal and property data necessitates robust security measures to protect against breaches and unauthorized access. Real estate companies must ensure compliance with data protection regulations and implement secure data handling practices.

Ethical considerations are crucial when implementing AI in real estate. Bias in AI algorithms can perpetuate unfair housing practices and lead to discrimination. It is imperative to address bias and promote diversity in data collection and algorithm design to ensure equitable outcomes. Transparency and explainability of AI decisions are also essential for fostering trust among stakeholders and avoiding potential legal and ethical challenges.

Looking ahead, the future of AI in real estate holds tremendous potential. Emerging technologies such as natural language processing, computer vision, and blockchain will further enhance AI capabilities in the industry. Natural language processing will enable more advanced conversational AI interfaces, allowing customers to interact with real estate platforms using voice commands. Computer vision will enhance property inspection processes, enabling automated property condition assessments and identifying maintenance needs. Blockchain technology will enhance transparency and security in property transactions, facilitating secure and efficient property transfers.

However, several challenges must be addressed for the successful adoption of AI in real estate. Upskilling and training real estate professionals to adapt to AI technologies is crucial to fully leverage the benefits they offer. Ethical guidelines and regulations must be developed and implemented to ensure responsible AI usage in the industry. Ongoing efforts to address biases and promote diversity in data collection and algorithm design are essential to building fair and inclusive real estate practices.

Artificial intelligence (AI) has ushered in a new era in the real estate industry, revolutionizing the way properties are transacted, managed, and experienced. Throughout this article, we have explored the transformative potential of AI in various aspects of real estate and its implications for the future of the property market.

Automated Valuation Models (AVMs) have emerged as a game-changer in property transactions and insurance. By leveraging AI algorithms and vast amounts of data, AVMs have increased the accuracy and efficiency of property valuations, streamlining the buying and selling process. Additionally, insurance companies are adopting AVMs to assess risk and determine premiums, leading to faster and more informed decisions.

Furthermore, AI has the power to support the development of affordable housing. With its ability to analyze market trends, predict demand, and identify potential areas for affordable housing development, AI is empowering policymakers and developers to make data-driven decisions. By streamlining processes and reducing costs, AI can contribute to the creation of more affordable housing options, addressing the pressing issue of housing affordability.

AI also holds the promise of reducing resource use and improving the tenant experience. Smart building management systems powered by AI algorithms can optimize energy consumption, reduce waste, and enhance sustainability in real estate operations. Tenants can benefit from personalized experiences through AI-driven technologies such as smart home devices and virtual assistants, enhancing comfort, convenience, and overall satisfaction.

However, as the adoption of AI in real estate expands, it is crucial to address data security and ethical considerations. Safeguarding personal information and ensuring compliance with data protection regulations are paramount to building trust and maintaining the integrity of AI-powered systems. Additionally, addressing biases in AI algorithms and promoting transparency and fairness are essential to avoid perpetuating existing inequalities in the real estate sector.

Looking ahead, the future trends and challenges in the integration of AI in real estate are exciting and complex.

Emerging technologies such as blockchain, augmented reality, and natural language processing will further enhance the capabilities of AI in the sector. However, challenges such as upskilling the workforce, establishing regulatory frameworks, and addressing potential job displacement require proactive measures and collaboration between industry stakeholders.

AI is revolutionizing the real estate industry, paving the way for a more decentralized and efficient sector. With AVMs, affordable housing initiatives, resource optimization, and personalized experiences, AI is reshaping the future of property. These tools enable not only established investors but also government entities, non-profit organizations, and individual investors to participate actively in the market. Through the democratization of real estate investment and development, AI-powered tools have the potential to make affordable housing a more attainable reality for many while unlocking opportunities for fractional investments.

Ultimately, this inclusive approach aspires to build wealth through real estate for individuals and communities that have been previously excluded due to the formidable barriers of entry, such as high capital and costs. With AI at the forefront, the real estate industry is entering a new era of accessibility and opportunity for all.

Peter Zeihan: Europe Goes Nuclear

We’ve got two major developments in Eurasia. We’re talking about Ukraine disabling two ships in the Caspian Sea and Poland getting EU approval to build…

Thought Leader: Peter Zeihan

Dr. Sanjay Gupta’s Top Health Stories of 2025

From the resurgence of measles to a new way to treat pain, 2025 was a challenge for public health while still offering moments of hope. Sanjay…

Thought Leader: Sanjay Gupta

Ian Bremmer: The state of global conflict in 2025

On GZERO World, Ian Bremmer takes a hard look at the biggest global crises and conflicts that defined our world in 2025 with CNN’s Clarissa…

Thought Leader: Ian Bremmer