One reason so many are quitting: We want control over our lives again

The pandemic, and the challenges of balancing life and work during it, have stripped us of agency. Resigning is one way of regaining a sense…

Thought Leader: Amy Cuddy

In a recent Financial Times column, Sheila Bair examines the unusual political alignment between President Donald Trump and Senator Elizabeth Warren around a proposal to cap U.S. credit card interest rates at 10 percent for one year. While the legislation faces long odds, Bair argues that the debate usefully exposes how historically high credit card rates have strained American households.

Bair challenges banks’ claims that a 10 percent cap would make lending unprofitable or force widespread credit withdrawals. She notes that credit card rates remained elevated even when the Federal Reserve held benchmark interest rates near zero after the 2008 financial crisis and again during the pandemic. Today, average credit card rates hover above 20 percent—far higher than pre-crisis levels—despite evidence that default losses do not justify such wide spreads.

Citing research from the New York Fed and Vanderbilt University, Bair argues that banks could continue serving most customers profitably under a lower cap, particularly if they reduced spending on marketing and rewards programs. She also suggests that lower rates would ease household budgets, reduce reliance on payday loans, and potentially support broader consumer spending.

However, Bair cautions that a flat 10 percent cap may be too low and could harm marginal borrowers. Instead, she proposes a permanent cap tied to a fixed spread above the federal funds rate—closer to historical norms—which would protect consumers while preserving flexibility for banks as interest rates change.

With Americans paying roughly $160 billion a year in credit card interest, Bair concludes that banks have failed to pass on the benefits of past low-rate policies. As benchmark rates begin to fall again, she argues, banks could proactively lower credit card rates—or risk having reform imposed by an unlikely political coalition.

Visit the Financial Times to read the full article.

A globally recognized authority on financial regulation and economic policy, Sheila Bair led the FDIC through the 2008 financial crisis and has since continued to shape the future of finance through leadership roles in government, academia, and the private sector. Named to Time’s “Top 100” and Forbes’ “Most Powerful Women” lists, she is a trusted voice on stability, reform, and consumer protection in the global economy. To bring Sheila Bair’s insight and leadership to your next event, contact WWSG.

One reason so many are quitting: We want control over our lives again

The pandemic, and the challenges of balancing life and work during it, have stripped us of agency. Resigning is one way of regaining a sense…

Thought Leader: Amy Cuddy

Molly Fletcher: Can drive offset your burnout at work?

This piece is by Molly Fletcher. People assume that drive depletes energy. They believe that level of intensity, focus and daily effort leads to burnout.…

Thought Leader: Molly Fletcher

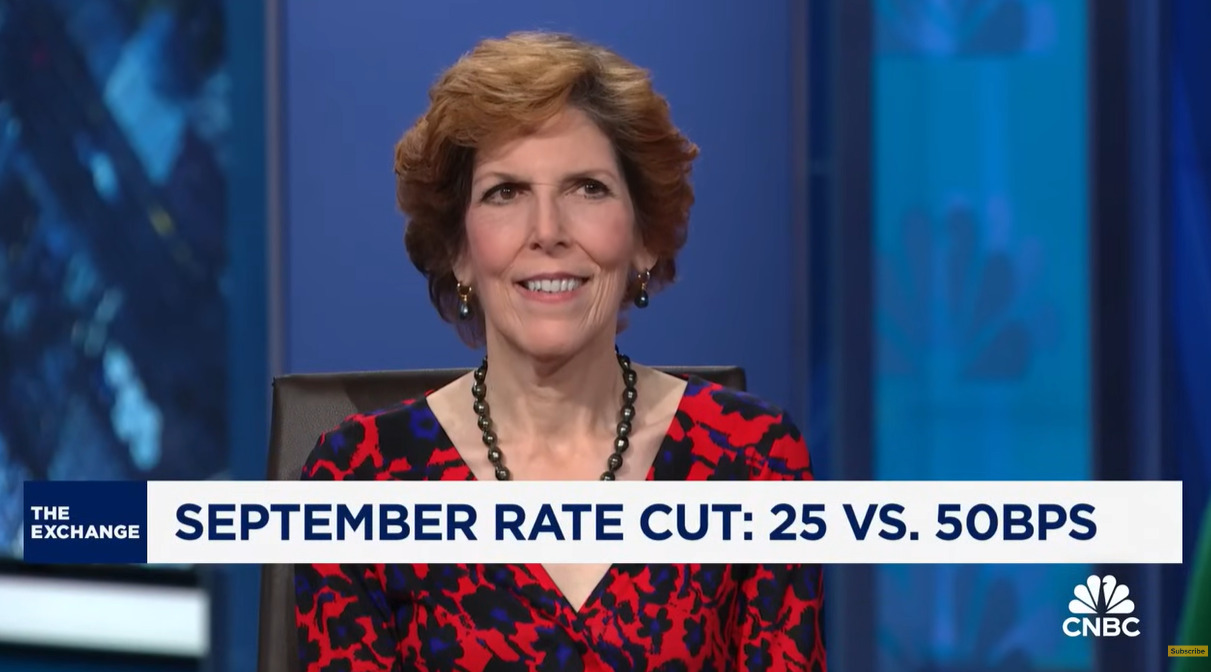

Loretta Mester: Fed most likely to cut rates by quarter point

Former Cleveland Fed president Loretta Mester joins CNBC’s ‘The Exchange’ to discuss her expectations for rate cuts, whether the Fed’s focus should be on rates…

Thought Leader: Loretta Mester