One reason so many are quitting: We want control over our lives again

The pandemic, and the challenges of balancing life and work during it, have stripped us of agency. Resigning is one way of regaining a sense…

Thought Leader: Amy Cuddy

The writer is the former chair of the FDIC and author of the upcoming book ‘How Not to Lose a Million Dollars’ Smarting from recent election losses and growing voter discontent over the high cost of living, the Trump administration has renewed its assault on the Federal Reserve for keeping mortgage rates “too high”.

The administration is right to blame the Fed for the high costs of housing, but this is not because it has kept mortgage rates too high. It is because it kept them too low and for too long in years past. Housing affordability continues to be driven by supply shortages. Lower rates will increase demand, making housing inflation worse.

The great financial crisis led to a collapse in home prices and housing construction. In a desperate attempt to revive the economy and property market, the Fed resorted to the controversial practice of quantitative easing to lower longer-term rates on mortgages and US Treasuries.

It purchased vast amounts of mortgage-backed securities, driving up their prices and thus lowering yields. The Fed gradually amassed $1.7tn in MBS — representing about 30 per cent of the total market. Mortgages trended down to the 4 per cent range. Pre-crisis they had hovered about 6 to 7 per cent (about where they are now).

The Fed’s efforts initially made sense. However, it kept QE going far too long. Over the ensuing years demand rose, but supply did not keep pace, creating upward pressure on home prices. Then the pandemic hit. In March 2020, the Fed again embarked on massive purchases of mortgage-backed securities, reaching peak holdings of $2.7tn in 2021. Mortgage rates plunged, sinking as low as 2.65 per cent. Combined with the growing popularity of remote work, this led to a steep increase in the demand for homes, in a still supply-constrained market. The result was average annual home prices spiking by double digits. Home prices increased by 47 per cent between 2020 and 2024.

While ultra-low mortgage rates juiced new demand for housing, it had an even a bigger impact on refinance activity with homeowners rushing to secure lower rates. About one-third of outstanding mortgage debt was refinanced between 2020 and 2021.

But this exacerbated supply constraints. As mortgage rates have normalised, housing inflation has moderated, but it is still too high at about 4 per cent. A major problem is the resale market, which has suffered from chronic undersupply. Homeowners do not want to give up their cheap mortgages by moving. So, the Fed’s actions had a double whammy: they produced red-hot housing inflation while worsening supply imbalances.

This whole sorry history demonstrates the folly of using demand-side stimulus in supply-constrained markets. Yet, the administration continues to prioritise demand-side measures to address housing affordability. It has proposed a 50-year mortgage which, by extending the loan term, would lower monthly payments. This could draw more buyers into housing markets, but only with mortgages that double their interest costs over the standard 30-year mortgage and take decades to build significant equity.

The proposal confuses home affordability with mortgage payment affordability. Working families need homes at prices they can manage and mortgages that help them build wealth.

Blue-state Democrat leadership — which contributed to shortages with restrictive zoning and permitting requirements — has finally caught on that supply is the key problem. California, Colorado, Massachusetts, Maryland and Washington are all states that have embraced more permissive zoning and permitting requirements to expand the supply of low-cost, affordable homes.

Bipartisan legislation, co-sponsored by senators Tim Scott and Elizabeth Warren to cut red tape and provide financial incentives for new housing, has passed the Senate, but it needs a boost from the administration to pass the House. This would be far more productive than Fed bashing.

Fed chair Jay Powell has laudably committed to a continued run-off of the central bank’s portfolio of MBS and vowed that the Fed would not again intervene in that market with purchases.

Will the Fed’s next, Trump-appointed chair succumb to pressure and resume them, though? It would be ironic if, as Democrats finally embrace deregulation to address housing supply, Republicans embrace the failed demand-side approaches that caused the very inflation which helped elect President Donald Trump.

The GOP should own housing affordability as an issue, but to do so it must focus on building more homes, not the illusionary quick fix of monetary policy.

A globally recognized authority on financial regulation and economic policy, Sheila Bair led the FDIC through the 2008 financial crisis and has since continued to shape the future of finance through leadership roles in government, academia, and the private sector. Named to Time’s “Top 100” and Forbes’ “Most Powerful Women” lists, she is a trusted voice on stability, reform, and consumer protection in the global economy. To bring Sheila Bair’s insight and leadership to your next event, contact WWSG.

One reason so many are quitting: We want control over our lives again

The pandemic, and the challenges of balancing life and work during it, have stripped us of agency. Resigning is one way of regaining a sense…

Thought Leader: Amy Cuddy

Molly Fletcher: Can drive offset your burnout at work?

This piece is by Molly Fletcher. People assume that drive depletes energy. They believe that level of intensity, focus and daily effort leads to burnout.…

Thought Leader: Molly Fletcher

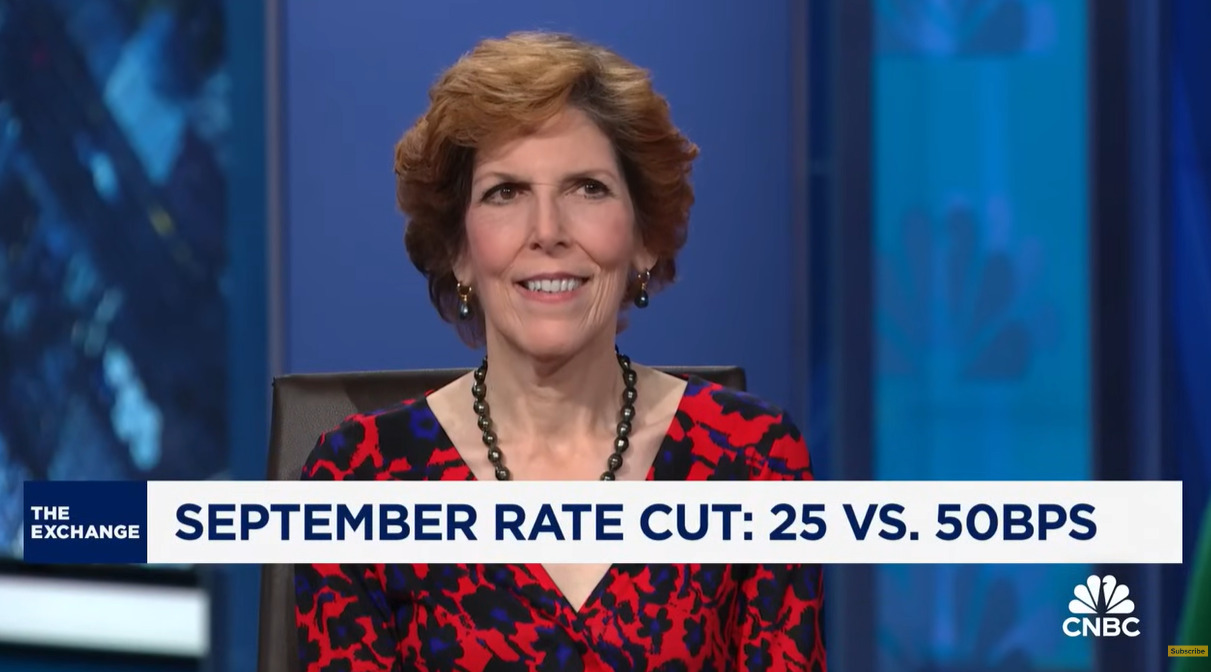

Loretta Mester: Fed most likely to cut rates by quarter point

Former Cleveland Fed president Loretta Mester joins CNBC’s ‘The Exchange’ to discuss her expectations for rate cuts, whether the Fed’s focus should be on rates…

Thought Leader: Loretta Mester