Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

From WWSG thought leader, Peter Goodman: Communities that suffered the worst of plant closings in recent decades are now gaining an outsize share of fresh investment and new jobs.

For much of the last half century, economic life in the heart of North Carolina has been dominated by factory closings, joblessness and downgraded expectations. Textile mills and furniture plants have been undercut by low-priced imports from Mexico and China. Tobacco processing jobs have disappeared.

Yet over the last several years, an infusion of investment in cutting-edge industries like biotechnology, computer chips and electric vehicles has lifted the fortunes of long-struggling communities.

North Carolina presents a conspicuous example of this trend, yet a similar story is playing out elsewhere. From industrial swaths of the Midwest to factory towns in the South, areas that suffered the most wrenching downsides of trade are now capturing the greatest shares of investment into forward-tilting industries, according to research from the Brookings Institution, a public policy research organization in Washington.

Brookings researchers examined pledges of private investment across the United States, using data compiled by the Biden administration as part of its campaign to subsidize domestic production of computer chips and electric vehicles. They also tapped a Massachusetts Institute of Technology database that tracks investments in clean energy. Over the last three years, $736 billion in investment has been promised for these key industries, the researchers found.

When they mapped the investments, the Brookings team concluded that nearly a third of the total is flowing into communities that experienced the worst effects of the so-called China Shock — the factory closures that followed China’s entry to the global trading system in 2001.

“There’s still an orientation toward production in these places,” said Mark Muro, a senior fellow at Brookings Metro and one of the authors of the study. Even as technology advances and products change, traditional manufacturing areas tend to retain the acumen and skills needed to make things, he said.

Those findings have undercut the tone of fatalism that often colors conversations about the risks of trade and automation, lending credence to the notion that government has tools to soften the effects for workers and communities: Targeted grants can spur the development of strategically important industries while yielding middle-class paychecks.

That takeaway is especially relevant given intensifying worries about a potential new China Shock. As the country’s economy slows, limiting the willingness of its consumers to spend, the Chinese government is steering more credit to exporters. That is sending growing volumes of goods into world markets, threatening factory jobs in higher-wage nations.

“These shocks are not one-offs,” Mr. Muro said. “They will be frequent. They are, unfortunately, part of the rocky ride you get by participating in a global economy.”

Ahead of a presidential election that may hinge on economic sentiments, the findings appear to bolster the case for so-called industrial policy, in which the government subsidizes strategic industries. The campaign has featured contrasting conceptions of how the United States should manage the opportunities and challenges of international trade.

Former President Donald J. Trump has described Chinese industry as a mortal threat to American livelihoods, while promising to impose steep tariffs on imports from China. Economists warn that this course risks lifting prices for many goods while undermining the competitiveness of factories in the United States that depend on imported components to make their products.

The Biden administration — while retaining and advancing many of the tariffs imposed by Mr. Trump — has also embraced subsidies in strategic industries to encourage American production. Economists have criticized that approach as a form of trade protectionism that imperils American alliances. The political risks are heightened by the reality that the benefits are likely to take years and billions of dollars in investment to emerge.

The Brookings research suggests that the benefits of subsidizing industry could be in the pipeline, at least in places like Chatham County, N.C.

For decades, the county suffered the consequences as furniture manufacturing and textile jobs vanished. It largely missed out on the biotechnology boom that played out to the northeast, in the Raleigh-Durham area.

Between 1992 and 2023, manufacturing as a share of total employment in Chatham County dropped to 10 percent from 47 percent, according to data from the NC Budget & Tax Center.

Yet the county has harnessed its abundance of developable land and its legacy as a center for manufacturing to attract major investments.

In June 2023, Wolfspeed, a company that makes raw materials for computer chips used in electric vehicles, broke ground on a plant occupying 450 acres in the town of Siler City, home to about 8,000 people.

A $5 billion investment, the new factory recently gained approval from the Commerce Department for a $750 million federal grant under the CHIPS and Science Act — a centerpiece of the Biden administration’s campaign to make computer chips in the United States.

“This is going to allow us to build out the manufacturing lines faster,” said Wolfspeed’s chief executive, Gregg Lowe.

The company anticipates beginning production in the middle of next year, eventually generating 1,800 jobs. Building the facility has created paychecks for some 2,800 construction workers.

Wolfspeed picked the site in part because it already held the infrastructure to deliver enormous volumes of water — a carry-over from its previous incarnation as a center for textiles. Wolfspeed’s technology, which centers on a material called silicon carbide, entails growing crystals in temperatures reaching 4,500 degrees (2,500 degrees Celsius), or roughly half the temperature of the surface of the sun. Water is crucial for the cooling process.

Elsewhere in Chatham County, a Vietnamese company that makes electric vehicles, VinFast, has pledged to invest $4 billion on a new factory that it said would employ some 7,500 people. Development has been repeatedly delayed, but work on the factory is expected to begin this year, said Michael Smith, president of the Chatham County Economic Development Corporation.

Just to the west, in neighboring Randolph County, Toyota is testing its initial batch of electric vehicle batteries at a new factory — a $14 billion investment. North Carolina also boasts mines and refineries for lithium, a key raw material for batteries.

Collectively, these operations have transformed a region once synonymous with decline into a hub for forward-looking industry.

“That’s the full stack for building electric vehicles,” said Aaron Chatterji, an economist at Duke University who previously helped to establish the CHIPS Act. “You’re building a cluster that we can continue to build on.”

In Michigan, another state long characterized by diminished industry, prospects are being revived by investments in electric vehicle and battery plants.

In Flint, the birthplace of General Motors, a Chicago-based company called NanoGraf is constructing a factory to make components for batteries. It was recently awarded a $60 million Department of Energy grant.

The plant is being erected on land that was previously home to Buick City, a factory complex where 30,000 people worked in the heyday of the American auto industry.

Representative Dan Kildee, a Democrat whose district includes Flint, but who is not running for re-election, grew up within blocks of the Buick City plant. His grandfather, a former lumberjack, moved there for a job on the assembly line. Wage earners drove home in cars they helped build and spent vacations in lakefront cottages.

When jobs were shipped to lower-wage countries, the damage went beyond finances, seeping into the psyche of the community. The abandonment of Buick City in 1999 cemented Flint’s status as a fallen icon.

Now, a new sense of confidence is palpable. “There’s this sort of turning of the page in this region,” Mr. Kildee, 66, said.

NanoGraf saw in Flint a community with roots in manufacturing where skilled people could be trained by community colleges to handle the needed work.

Company leaders also appreciated the symbolic power of advancing electric vehicles on the same ground that was integral to the rise of gas-powered cars in the previous century.

“It’s about revitalizing the community,” Francis Wang, the company’s chief executive, said. “We’re transforming the Rust Belt into the Battery Belt.”

Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

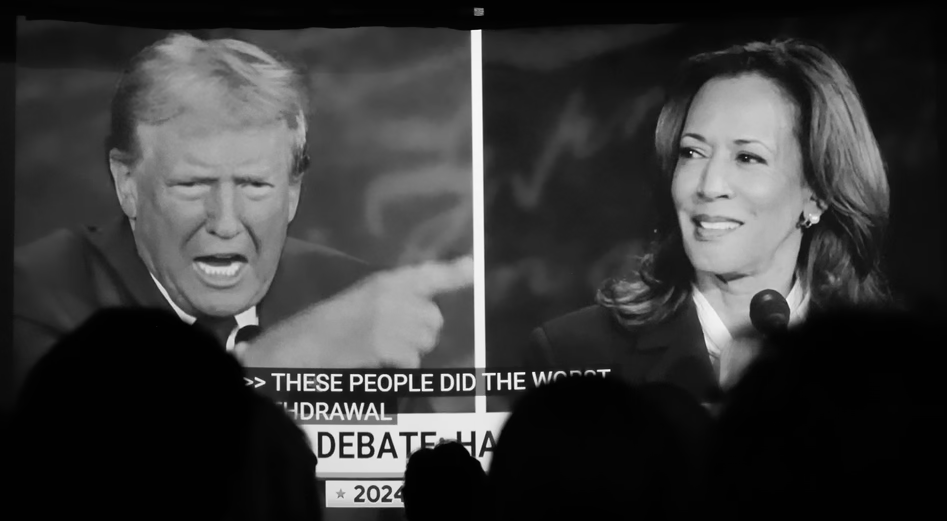

David Frum: How Harris Roped a Dope

This piece is by WWSG exclusive thought leader, David Frum. Vice President Kamala Harris walked onto the ABC News debate stage with a mission: trigger…

Thought Leader: David Frum

Michael Baker: Ukraine’s Faltering Front, Polish Sabotage Foiled, & Trump vs. Kamala

In this episode of The President’s Daily Brief with Mike Baker: We examine Russia’s ongoing push in eastern Ukraine. While Ukrainian forces continue their offensive…

Thought Leader: Mike Baker