Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

From WWSG thought leader, Peter Goodman: Eight years ago, when a newly elected Donald J. Trump promised to apply the powers of the Oval Office to start a trade war with China, the target of his ire was widely viewed as a juggernaut. China was the indispensable factory floor to the world and a swiftly developing market for goods and services.

As Mr. Trump now prepares for his second stint in the White House, he is vowing to intensify trade hostilities with China by imposing additional tariffs of 60 percent or more on all Chinese imports. He is pressuring a country that has been chastened by a powerful combination of overlapping forces: the calamitous end of a real estate investment binge, incalculable losses in the banking system, a local government debt crisis, flagging economic growth and chronically low prices — a potential harbinger of long-term stagnation.

The decline of fortunes at home has made Chinese companies especially focused on sales abroad. And that makes the country vulnerable to any threat to its export growth, a weakness that would enhance the expected pressure from the Trump administration as it plans to seek a deal that would increase Chinese purchases of American goods.

“The balance of power has certainly shifted in favor of the United States,” said Eswar Prasad, a professor of trade policy at Cornell University who was previously the head of the China division at the International Monetary Fund. “The Chinese economy is not quite on the ropes, but it has been struggling for a while.

Yet complicating factors beneath that widely shared assessment may strengthen China’s ability to endure whatever measures the incoming Trump administration may have in store.

Most immediately, the Chinese government possesses formidable resources to stoke the domestic economy. After long declining to loosen credit for fear of reviving investment in real estate, China’s central bank this year lowered borrowing costs for homeowners and businesses. On Friday, the government approved a $1.4 trillion rescue plan that would allow local governments to refinance existing debts at lower rates of interest.

At the same time, a government-led strategy to advance the nation’s industrial prowess has turned China into the dominant supplier of electric vehicles and other clean energy technologies. That gives Chinese companies a hold on rapidly growing markets for critical wares regardless of American tariffs. In an era of rising alarm over climate change, the world can either use Chinese-made gear to limit carbon emissions or shun Chinese industry. At least for now, it is struggling to do both.

China is less dependent on access to American markets than it was the last time Mr. Trump ratcheted up tariffs. The wave of American import duties imposed by the Trump administration, beginning in 2018 and continuing under the Biden administration, eventually covered some $400 billion in Chinese goods. Chinese factories in turn looked to Southeast Asia and Latin America for customers.

Over the last six years, China’s share of American imports has dropped to 13 percent from 20 percent, according to TS Lombard, an investment research firm in London, though some of that shift reflects goods that end up in the United States after being routed through countries like Mexico and Vietnam in order to avoid American tariffs.

As Europe has more recently added its own tariffs to Chinese-made electric vehicles, China has accelerated its push to expand sales in other regions.

“Beijing is using the Global South to offset the loss of market share to the West,” said Jie Yu, a senior research fellow at Chatham House in London.

China’s leaders have taken a similar approach to goods like agricultural commodities, shifting some purchases of soybeans from American farmers to suppliers in Brazil and Argentina.

That experience may give Beijing confidence that it can hold firm against escalating tariffs and retaliate with reductions in American imports, especially of agricultural products. China could also further restrict its exports of critical minerals.

“China has more leverage than the first time around,” said Scott Kennedy, a China expert at the Center for Strategic and International Studies in Washington. “It has a range of tools it can mobilize to push back and put some hurt on the U.S. economy if it believes Trump is pursuing outright economic war.”

Mr. Trump may opt to moderate his threats of tariffs, concluding that the American economy would be imperiled by them. Economists warn that widespread taxes on imports would increase consumer prices and stymie domestic manufacturers that rely on imported components.

Still, if Mr. Trump does follow through, Chinese industry would suffer.

Exports would plunge by 8 percent over the following year while shaving 2 percent off China’s annual economic growth, estimates Larry Hu, chief China economist at Macquarie Group, an Australian financial services firm. And if Mr. Trump seeks to close off imports of goods made by Chinese companies in other countries like Mexico, the damage would be greater still.

China’s increased susceptibility to trade disruption is underscored by the fact that the country now produces 17 percent of global exports, up from 12 percent during Mr. Trump’s first term, according to TS Lombard.

Chinese industry is often described as being dominated by large, state-owned companies that are governed through crippling bureaucracy and the imperatives of the ruling Communist Party, making them ill-suited to adjust to changing market conditions — another ostensible source of American leverage.

But this conception misses the emergence of a vast and far more nimble private sector, which now accounts for roughly half of Chinese exports, compared with 9 percent for state-owned companies, according to Nicholas R. Lardy, a China expert at the Peterson Institute for International Economics in Washington.

“This has been a tremendous structural change,” Mr. Lardy said. “It gives them more adaptability.”

The Chinese government has the capacity to compensate for diminished exports by turning on spending, experts say. It can deploy its state-owned banks and corporate giants toward national goals like economic growth.

So far, the stimulus plans emerging from Beijing have been more gradual and modest than some anticipated. Still, they have resonated as a signal that China’s leaders are concerned about public dissatisfaction with stagnating living standards and have resolved to promote economic growth.

“Traders I speak to in China, they describe it as going from your deathbed straight to a nightclub,” Rory Green, chief China economist at TS Lombard, said. “It’s a huge change in an array of policies.”

The pivot toward stimulus by Beijing underscores a central feature of the Chinese system in adapting to shocks. Ruled by the all-powerful Chinese Communist Party, the country operates with draconian controls on individual expression and absent free elections. Yet once the Party settles on the need for an emergency course, it has the power to quickly establish policies free of the impediments found in democratic societies.

“In terms of moving quickly and resolving a crisis, the C.C.P. is highly effective,” Mr. Green said. “They have a lot of levers to pull.”

China’s president, Xi Jinping, has spent the last decade consolidating power and securing an unlimited claim on his office.

When Mr. Trump first took office in 2017, Mr. Xi was only four years into his tenure and still legally restricted to two five-year terms. He had only recently embarked on an initiative known as Made in China 2025: The government directed cheap land, voluminous state credit and highly trained experts toward increasing the country’s capacity in 10 advanced technology industries.

In crucial areas, that plan has achieved extraordinary returns. China now controls at least 60 percent of the global capacity to make solar cells, wind turbines, batteries and other components for energy systems that reduce carbon emissions, according to the International Energy Agency. Chinese investment amounts to an even higher share of announced expansions.

Chinese companies are increasingly dominant in the realm of mobile telephones, with eight of the 10 largest brands by volume headquartered in China, according to a study by the Asia Pacific Foundation of Canada.

In one regard, the Chinese plan has pointedly failed to achieve a critical objective — closing the gap in capability that separates domestic computer chips from the most advanced varieties made in Taiwan, using technology from the United States, Europe and Japan.

The Biden administration has employed export controls on American companies while pressuring allies to withhold technology that could allow Chinese industry to catch up.

But that campaign may have indirectly increased China’s ability to withstand whatever trade restrictions are on the way, some experts assert.

“These export restrictions are accelerating China’s drive for self-sufficiency,” Mr. Lardy, the Peterson Institute economist, said. “This idea that we can slow them down across the board strikes me as uninformed.”

Mr. Trump’s next wave of proposed tariffs would present a challenge. Yet it would also reinforce a notion that has gained currency in Beijing: that China can no longer rely on foreign markets to supply needed components and technologies.

“Chinese leadership will learn a hard lesson that they cannot really depend on anyone but themselves,” said Lynette Ong, professor of Chinese politics at the University of Toronto. “Trump’s second term may be a gift for China’s economic self-reliance.”

Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

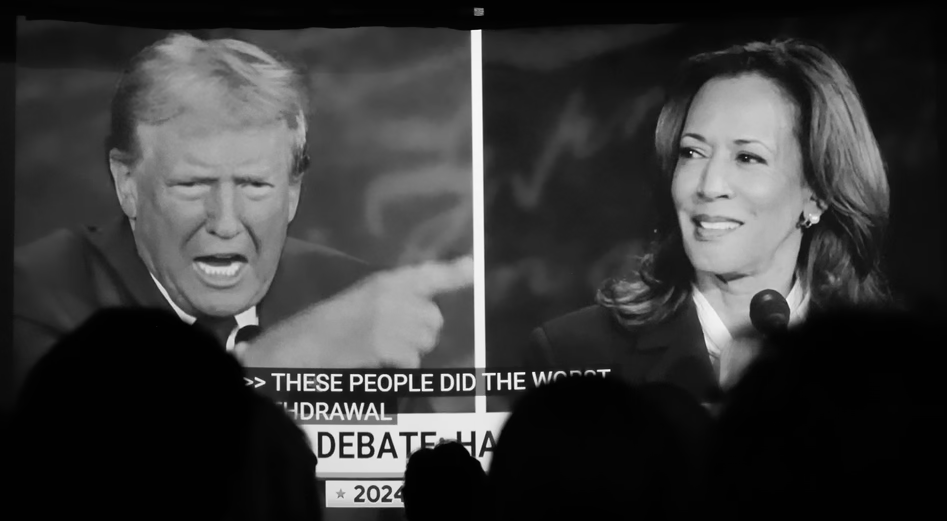

David Frum: How Harris Roped a Dope

This piece is by WWSG exclusive thought leader, David Frum. Vice President Kamala Harris walked onto the ABC News debate stage with a mission: trigger…

Thought Leader: David Frum

Michael Baker: Ukraine’s Faltering Front, Polish Sabotage Foiled, & Trump vs. Kamala

In this episode of The President’s Daily Brief with Mike Baker: We examine Russia’s ongoing push in eastern Ukraine. While Ukrainian forces continue their offensive…

Thought Leader: Mike Baker