Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

Much ink has been spilled in recent weeks, and hours of cable news spent, debating whether the Federal Reserve’s independence is under political threat. But lost in these debates is an equally dangerous challenge: People often misunderstand what the Fed does—and what it legally can’t do. That misunderstanding poses a hidden threat to the institution’s independence.

Early in my tenure at the Fed, I sat down with a group of protesters to hear their concerns. One man in particular stood out. Passionate, persistent and frustrated, he made clear that he held a Ph.D. in economics from a major university. He insisted that the Fed provide loans directly to struggling nonprofits and community organizations. I interjected to explain that doing so would be illegal. Congress hasn’t authorized the Fed to lend to those groups, only to banks and financial institutions under certain conditions. He seemed genuinely surprised.

That moment stayed with me, not because of the confrontation, but because it illustrated something more troubling: Misplaced expectations erode the Fed’s independence. When the public expects things from the central bank it isn’t designed, or authorized, to do, disappointment is inevitable. And disappointment, when widespread and sustained, corrodes trust.

Take interest rates. When people demand that the Fed cut rates, they’re usually talking about mortgage rates, car loans or credit-card rates. But the Fed directly controls only the federal-funds rate, an overnight rate at which banks lend to one another. The rates that consumers care about are largely determined by the market, especially for long-term borrowing like mortgages.

Consider what happened in the fall of 2024. The Fed reduced the federal-funds rate by a percentage point, yet by early 2025 10-year Treasury yields had climbed by the same amount. Despite the Fed’s rate cuts, borrowing costs went up. Why? Because the Fed doesn’t control those long-term rates; the market does.

Could the Fed try to influence rates through asset purchases, buying long-dated Treasury securities, for example? Yes, but it would expand the Fed’s balance sheet significantly, a move typically reserved for periods of financial crisis. In today’s environment, such an intervention would be both unwarranted and potentially destabilizing.

The real drivers of long-term rates are basic supply and demand. When the federal government issues large quantities of debt, and demand doesn’t rise to match, bond prices fall, and yields rise, pushing up long-term borrowing rates. This isn’t a monetary policy problem; it’s a fiscal one. Expecting the Fed to offset fiscal imbalances or suppress long rates indefinitely isn’t only unrealistic, it’s dangerous.

I spent a decade at the Fed, and I care deeply about the institution and its ability to serve Americans. Its independence is essential to maintaining price stability, supporting full employment and ensuring the security of the financial system. But that independence can only be sustained if the public understands and respects the Fed’s role and its limits.

As we navigate the complex economic challenges ahead, from inflation and fiscal pressures to geopolitical risk and labor market shifts, let’s recognize what the Fed can actually do. If we don’t respect what the Fed is—and isn’t—we risk losing one of the few institutions still capable of rising above politics to serve the long-term good.

Former Federal Reserve Bank President, Wharton Dean, and university leader, Dr. Patrick Harker offers rare insight at the intersection of economics, policy, and innovation. With deep experience in both the public and private sectors, he breaks down complex issues into clear, actionable takeaways for today’s business and civic leaders. Contact us today to bring Harker to your next speaking event.

Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

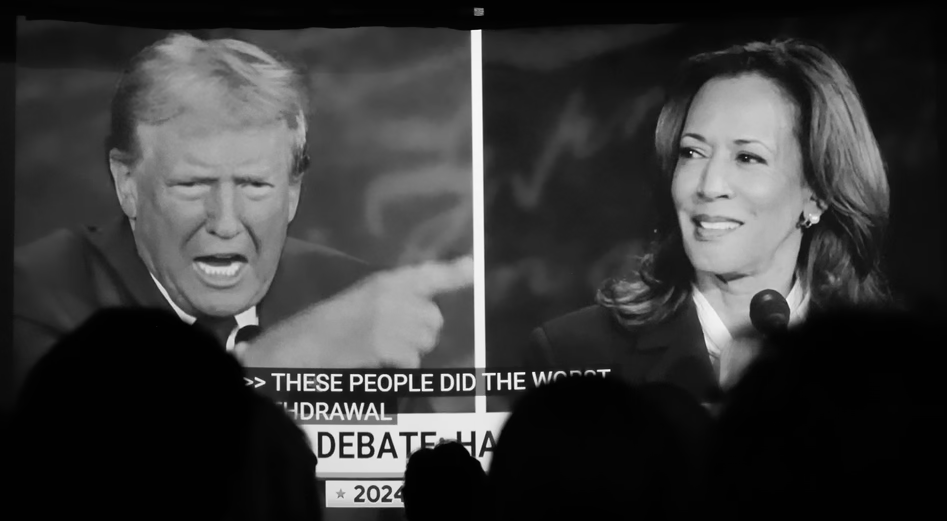

David Frum: How Harris Roped a Dope

This piece is by WWSG exclusive thought leader, David Frum. Vice President Kamala Harris walked onto the ABC News debate stage with a mission: trigger…

Thought Leader: David Frum

Michael Baker: Ukraine’s Faltering Front, Polish Sabotage Foiled, & Trump vs. Kamala

In this episode of The President’s Daily Brief with Mike Baker: We examine Russia’s ongoing push in eastern Ukraine. While Ukrainian forces continue their offensive…

Thought Leader: Mike Baker