Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

DAVOS, Switzerland — Eight years ago, Davos Man mocked Donald Trump. Five years ago, he despised Trump. But in 2025, the mood at the World Economic Forum has completely changed.

The great American vibe shift has made it to Davos, and the European business elite badly wants a piece of it. Two days of trudging up and down the Promenade—the main drag of the Swiss ski resort town where the WEF is held each year—were enough to convince me of that.

True, the WEF propaganda remains fixated on Environmental, Social, and Governance issues, and, of course, Diversity, Equity, and Inclusion—the familiar, woke-globalist acronyms ESG and DEI, now supplemented with AI. The corporate billboards still burble their word salads about resilience and sustainability. But talk to the chief executives and a very different picture emerges.

Almost everyone at Davos is long U.S., short EU. The new Davos consensus is that Europe cannot get its economic act together and never will, whereas America is rocking and rolling, and if you don’t own the big U.S. tech stocks, then the FOMO may kill you. Börje Ekholm, the CEO of Swedish telecom firm Ericsson, told one interviewer that he was fed up with Europe’s “regulatory-first approach.” I heard the same thing again and again. “Europe is always lagging behind,” complained Zurich Insurance Group CEO Mario Greco. Vasant Narasimhan, who runs the Swiss pharmaceutical firm Novartis, agreed.

“It’s Europe that needs Elon,” one of the Continent’s biggest asset managers said at a lunch I attended. “Individually, each European regulation seems okay but, like the drinks in the cocktail bar, if you mix them all together, it tastes nasty.” Someone needs to Make Europe Great Again, says Davos Man. Sure, last year, Mario Draghi produced a report on EU competitiveness that made some concrete suggestions. But whoever made anything great again with a report?

The trouble is that the Davos consensus is nearly always wrong. I still remember the way it was five years ago. It was clear to me—and I told everyone who would listen—that a global pandemic was underway. But what was the dominant topic on the agenda of the World Economic Forum? That’s right: climate change and how morally superior Greta Thunberg was to wicked Donald Trump. So, if Davos Man is, despite his qualms, long America and short Europe, that might be your cue to take the other side of the trade.

Despite the predictable concerns of the 23 Nobel laureate economistswho endorsed Kamala Harris last year, the risk to the U.S. economy does not lead from tariffs to inflation. The real risk is from the deficit to the bond market. The total federal debt exceeds 120 percent, double its level in the mid-1990s. The deficit Trump has inherited from Joe Biden is above 6 percent of GDP, a staggering number for an economy at nearly full employment. Debt-servicing costs now, for the first time, exceed the defense budget, a violation of Ferguson’s Law, which states, “Any great power that spends more on interest payments than on defense will not remain a great power for very long.”

Why did the United States not suffer the recession that nearly all economists predicted in 2023 as a result of rate hikes by the Federal Reserve? Partly it was because Biden ran such huge deficits. The way the Treasury financed the borrowing—by issuing short-term paper—also partly offset the Fed’s tightening, as Nouriel Roubini and Stephen Miran have pointed out. But it was also, as Sahil Mahtani and others have argued, because the virtually open southern border flooded the U.S. economy with cheap labor in the form of roughly eight million immigrants.

The incoming Treasury secretary, Scott Bessent, has pledged to reduce the deficit by half to 3 percent of GDP. Either he is going to miss by a mile, and the extension of the 2017 tax cuts is going to overwhelm whatever gains in revenue come from deregulation and whatever cuts in spending come from greater government efficiency, or the U.S. is heading from fiscal expansion to fiscal tightening. As for the macroeconomic impact of an open border, that is clearly over, even before the deportations begin.

The indicator to watch is the 10-year Treasury yield—the long-term interest rate on government debt. Over the past three months, it has risen by half a percentage point. If it goes up further, things can get nasty for both the budget (as the costs of debt service rise) and for stocks (as investors start to discount future cash flows at a higher rate). Remember, Trump was sworn in with the S&P 500 at a record high, above 6,000. U.S. stocks—especially six of the Magnificent Seven—are eye-poppingly expensive relative to the rest of the world’s equity markets, even as these companies shell out half a trillion a year in capital expenditure on data centers and the other hardware that AI requires.

Bank of America expects the S&P to return 0-1 percent a year for the next decade—“a catastrophic investment prospect,” in the words of James Mackintosh of the Wall Street Journal. BCA Research analyst Peter Berezin predicts that the S&P will drop to 4,452 by the end of next year—a decline of close to 26 percent. To believe that the bull market will keep on keeping on, you have to believe in an immediate productivity miracle from the deployment of AI. I believe the productivity gains will come, as the bots replace the employees in call centers and back offices, but not nearly that fast.

Let me add two more big drops of rain on the Promenade parade. Since Adam Smith, economists have mostly seen free trade and the rule of law as beneficial for growth. Not only have we now entered a period of extreme uncertainty about the future path of U.S. trade policy (does Trump really mean to jack up tariffs on Canada, Mexico, and China on February 1, or are the threats just a negotiating tactic?), but we also appear to have jettisoned the rule of law in the euphoria of the monarchical moment.

It is not just Trump’s executive order suspending a law to ban TikTok that was passed by Congress, signed by his predecessor, and upheld by the Supreme Court. Trump has also issued a blanket pardon to all those convicted of crimes—including assaults on police officers—committed on January 6, 2021. And he has issued an executive order overturning the birthright citizenship most people had long assumed was enshrined in the Fourteenth Amendment.

But the truly disturbing thing to my eyes is that the assault on the rule of law has been bipartisan. And it is at least arguable that the Democrats began the process. It all started with their hounding of Trump in the courts, at least some of which was politically motivated, and continued in the final days of Biden’s presidency with his preemptive pardons of family members and political figures (they’re all here, including the one for his son Hunter), and a wild attempt to declare a constitutional amendment ratified (the Equal Rights Amendment) that hadn’t been.

“I believe in the rule of law, and I am optimistic that the strength of our legal institutions will ultimately prevail over politics,” Biden said in a statement justifying his actions. “But . . . ” You can stop reading right there. Because if you believe in the rule of law, “but,” then you don’t believe in the rule of law at all. It’s the same as those people who say they believe in free speech, but . . .

To be clear, I begin to fear we may be living through the death of the republic—the transition to empire that historical experience has led us to expect—but it’s not all Trump. It’s a truly bipartisan effort.

I am just fine with a vibe shift that gets us away from ESG, DEI, and the strangling regulation and ideologically motivated incompetence that lies behind the Los Angeles inferno, not to mention Chicago’s less spectacular descent into insolvency and criminality. If Davos Man needed Trump’s reelection to point out that if Europe went woke, it would go broke, then fine.

But trashing the rule of law is another matter.

And note how perfectly the phenomena coincide: the erosion of the laws and the imperial aspirations—Greenland; the Panama Canal; Canada(just kidding); the “Gulf of America;” and Mount McKinley, named for the president who, in addition to being the original Tariff Man, acquired Guam, the Philippines, and Puerto Rico, not forgetting Hawaii.

Twenty-one years ago, I published Colossus, which warned that the American empire was unlikely ever to succeed as long as the United States imports rather than exports people, borrows from abroad rather than invests at home, and loses interest in most of its military undertakings in five years on average. America’s manpower and fiscal and attention deficits have not got smaller since I wrote that book.

Davos Man wants the Trumpian vibe shift to come to Europe. And I get why. God knows, Europe needs fresh leadership, but not as much a Trump of their own as two dozen Javier Mileis.

As always, Davos Man should be very careful what he wishes for. Five years ago, the World Economic Forum crowd said they wanted net-zero emissions and a few months later, they got just that when Covid-19 shut the EU economy down. This year, ESG is out and MEGA is in. Well, let’s see how the trade plays out in 12 months’ time. You’ll know where to find me: trudging up and down the Promenade, in search of the Davos consensus, so I can take the other side.

Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

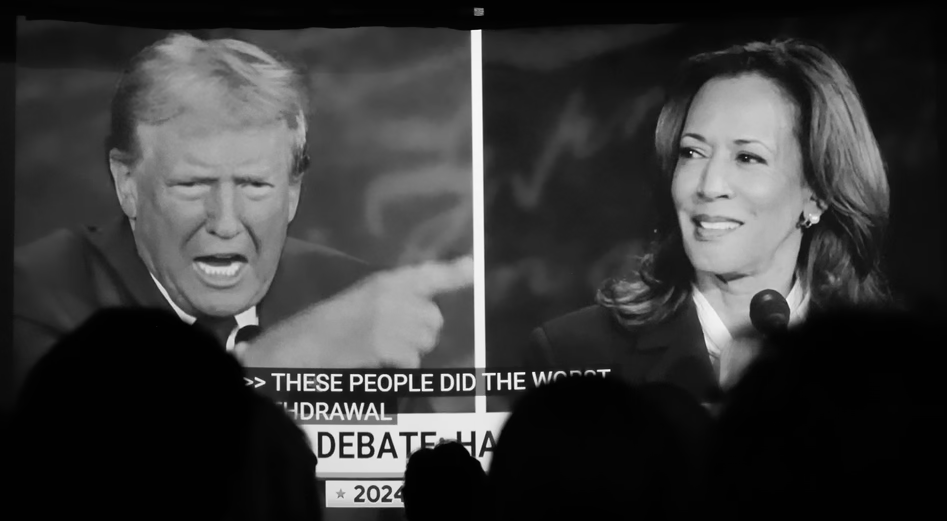

David Frum: How Harris Roped a Dope

This piece is by WWSG exclusive thought leader, David Frum. Vice President Kamala Harris walked onto the ABC News debate stage with a mission: trigger…

Thought Leader: David Frum

Michael Baker: Ukraine’s Faltering Front, Polish Sabotage Foiled, & Trump vs. Kamala

In this episode of The President’s Daily Brief with Mike Baker: We examine Russia’s ongoing push in eastern Ukraine. While Ukrainian forces continue their offensive…

Thought Leader: Mike Baker