Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

Members of Congress seeking to delay or stop a Big, Beautiful Bill of tax cuts, energy improvements, deregulation, economic growth, and better affordability are risking their futures.

Large portions of the 2017 Tax Cuts and Jobs Act were designed to expire at the end of this year.

Voting down the Big, Beautiful Bill will be a vote against tax cuts – and for a massive tax increase on virtually every American.

The House Ways and Means Committee listed all the tax increases which will hit American families if the Big, Beautiful Bill is defeated:

This scale of economic pain after four years of Biden-flation would be a disaster.

The American people would set out to punish every member of congress and senator who voted to raise their taxes and further cripple their standard of living.

The American people ranked the cost of living and affordability higher than stopping illegal immigration in the 2024 election. Every member, Democrat and Republican, who votes for a tax increase will have to explain it back home.

In addition to the personal family pain, the tax increases would devastate the economy. Small businesses would be crippled. Consumer spending would collapse. State and local governments would find their revenues collapsing as the economy tried to absorb the hit on American families.

It is more than possible to offset the cost of any tax cuts. Ignore the built-in internal liberal biases that have been injected into the system over the last 50 years. The Congressional Budget Office has a huge liberal bias. It consistently under-scores the benefits of reforms and over-scores the cost of tax cuts. Further, the 1974 Budget Act was written by liberal Democrats to favor spending increases and make tax cuts difficult.

When we balanced the budget – for four straight years for the only time in the last century – we had constant fights with CBO over its anti-reform, pro-spending bias. Ken Kies did a brilliant job helping us win the scoring fights. It was a key factor in balancing the budget.

If members use common sense – and not be trapped into Washington procedural baloney – they can easily offset any plausible costs. It is more than possible to reduce the deficit, stop tax increases, and pass additional tax cuts.

As Elon Musk and his team of young computer geniuses at DOGE have proven, the scale of fraud and waste in the lobbyist-bureaucratic machine is almost unimaginable. News articles have already cited millions and billions in waste and fraud.

As the largest single cost center in American life (almost 18 percent of the Gross National Product) health care has attracted a huge number of crooks. They have figured out how to rip off complacent, paper-based, slow systems with virtual impunity.

If we focus on Making America Honest Again, we can save enough money to pay for the Big, Beautiful Bill – and move toward a balanced budget (I know because I helped do it in the 1990s).

Finally, the tax, deregulation, energy, and affordability bill must pass by May or June.

While in Congress, I led the first House Republican majority in 40 years and the first re-elected House Republican Majority since 1928. I am shocked by the number of House and Senate Republicans who talk cavalierly about having two bills instead of one.

The Ronald Reagan tax cuts did not go into effect until 1983 – and Republicans lost 26 seats in the House in 1982. The 2017 tax cuts were passed in October and did not create enough economic momentum in 2018 – and Republicans lost 42 seats.

If we want to keep and grow the House Republican majority, we have to pass the tax cut, energy, deregulation, and affordability bill by May or June at the latest.

I am especially puzzled by senators who seem adamant about having two bills. They even admit they might not get to the tax bill until October.

Slow-walking President Donald Trump’s agenda is the path to Republican political suicide. It will almost certainly force President Trump to deal with a Democrat-led House in 2027. Then, we will all have to endure the same hostility, investigations, and impeachment attempts that Democrats brought after Republicans threw away the House in 2018.

When Americans realize that voting against the Big, Beautiful Bill is a vote for massive tax increases, it should sail through with a bipartisan majority.

There are 13 House Democrats in districts President Trump carried. Another 21 House Democrats are in districts he came within 5 percent of winning. If they vote to increase taxes on their constituents, they’ll have to own and explain it in the 2026 midterms.

The time to move is now. Congress must pass the Big, Beautiful Bill.

This article is written by WWSG thought leader, Newt Gingrich.

Time to end secret data laboratories—starting with the CDC

The American people are waking up to the fact that too many public health leaders have not always been straight with them. Despite housing treasure…

Thought Leader: Marty Makary

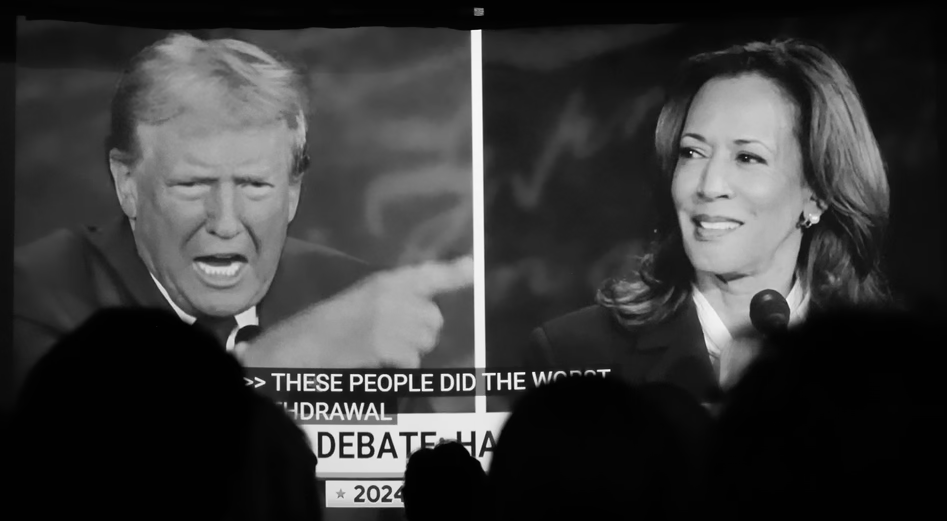

David Frum: How Harris Roped a Dope

This piece is by WWSG exclusive thought leader, David Frum. Vice President Kamala Harris walked onto the ABC News debate stage with a mission: trigger…

Thought Leader: David Frum

Michael Baker: Ukraine’s Faltering Front, Polish Sabotage Foiled, & Trump vs. Kamala

In this episode of The President’s Daily Brief with Mike Baker: We examine Russia’s ongoing push in eastern Ukraine. While Ukrainian forces continue their offensive…

Thought Leader: Mike Baker