One reason so many are quitting: We want control over our lives again

The pandemic, and the challenges of balancing life and work during it, have stripped us of agency. Resigning is one way of regaining a sense…

Thought Leader: Amy Cuddy

The two US Treasury chiefs in office during the global financial crisis warned about potential threats to the $29 trillion Treasuries market ranging from an unsustainable fiscal path to concerns about the political system in Washington.

“Our current trajectory is unsustainable” with regard to federal borrowing, former Treasury Secretary Henry Paulson said in an interview on CNBC Tuesday. “I don’t know whether that means you hit the wall, you know, in six months or six years, or whatever.”

Timothy Geithner, who succeeded Paulson at the start of 2009, said in the same CNBC interview that 10-year Treasury yields are trading at “pretty modest levels at the moment, reflecting some level of ultimate confidence the US will run the country in a sensible way.”

“But it depends ultimately on whether the system is able to bring revenues and expenditures back into balance, bring those deficits down a bit, and protect the things in terms of rule of law and Fed independence that make people confident” about Treasuries, Geithner said. “And there is a bit more of a shadow over those things than there’s been in some time.”

The two former Treasury chiefs are co-chairs of the Aspen Economic Strategy Group, and were speaking from Aspen, Colorado.

Paulson, who served under Republican President George W. Bush, called for a fiscal contingency plan to avert a meltdown in Treasuries. He said that might involve laying out a series of potential tax increases, such as a charge on consumption.

Geithner, who was in office under Democratic President Barack Obama, said the US could get “some good luck” from stronger productivity growth that would make fiscal challenges easier. He also said that President Donald Trump’s tariff hikes will be “hard to reverse” due in part to the revenue they’re raising.

“It’s going to be hard to get the political system to figure out a way to clean up and reform that legacy of tariffs, because they’re going to find that revenue so attractive,” Geithner said.

Both men said the tariffs will hurt US industry.

“I don’t like it when they prop up companies of the past, and hold back companies of the future,” Paulson said. He said import duties punish some areas of the economy while rewarding others, and “create distortions which have an adverse impact.”

Geithner termed tariffs a “corrosive tax on American manufacturers.” Even so, “it’s a hit that the US economy can withstand,” he said. “We’re an economy that is very hard to break.”

Both former Treasury secretaries also highlighted the importance the Federal Reserve’s independence, at a time when Trump regularly assails Chair Jerome Powell and his colleagues for refraining from lowering interest rates.

Fed independence is “very important to confidence in our economy” and in the dollar, Paulson said.

The status of Treasuries as “the foundational asset of the global financial system” reflects confidence in Fed independence along with protection of property rights, rule of law and the willingness to take sensible steps to “preserve the value of foreign investment” in the US, Geithner said.

The Honorable Henry M. Paulson, Jr. is one of the most influential voices on global economic, environmental, and geopolitical issues. As former U.S. Treasury Secretary and Chairman & CEO of Goldman Sachs, he brings unparalleled expertise in navigating financial crises and leading global institutions. Now Chairman of the Paulson Institute and TPG Rise Climate, Paulson drives impactful solutions at the intersection of finance, climate, and international policy. To bring Paulson to your next speaking engagement, contact us today.

One reason so many are quitting: We want control over our lives again

The pandemic, and the challenges of balancing life and work during it, have stripped us of agency. Resigning is one way of regaining a sense…

Thought Leader: Amy Cuddy

Molly Fletcher: Can drive offset your burnout at work?

This piece is by Molly Fletcher. People assume that drive depletes energy. They believe that level of intensity, focus and daily effort leads to burnout.…

Thought Leader: Molly Fletcher

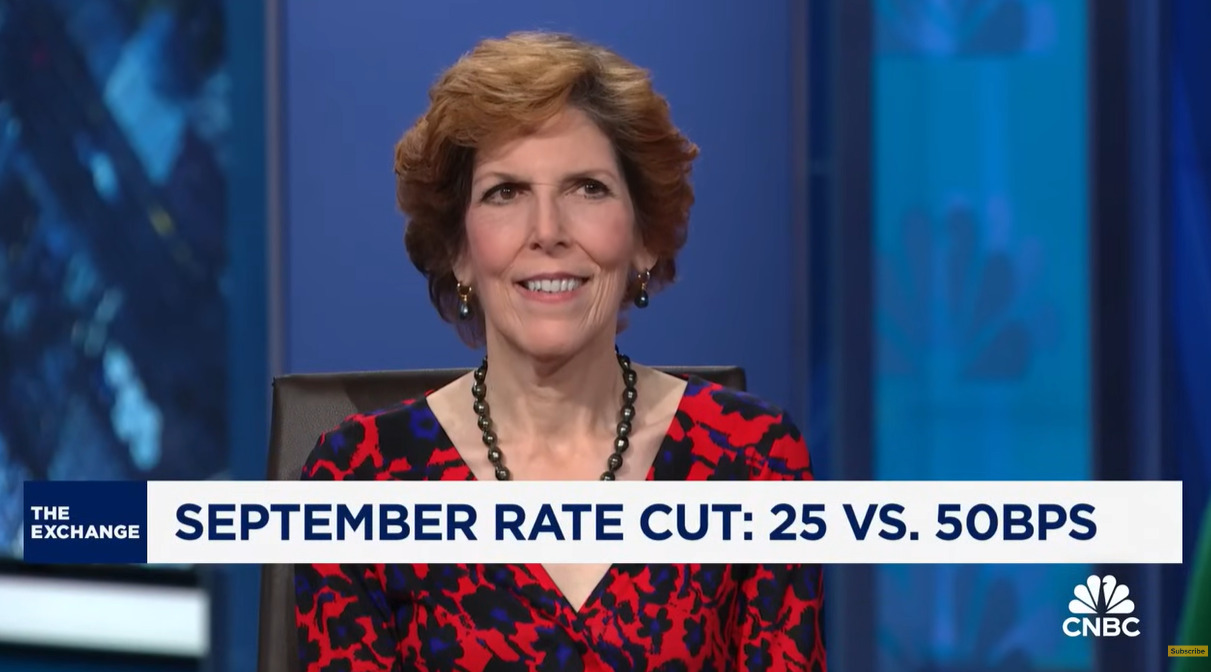

Loretta Mester: Fed most likely to cut rates by quarter point

Former Cleveland Fed president Loretta Mester joins CNBC’s ‘The Exchange’ to discuss her expectations for rate cuts, whether the Fed’s focus should be on rates…

Thought Leader: Loretta Mester